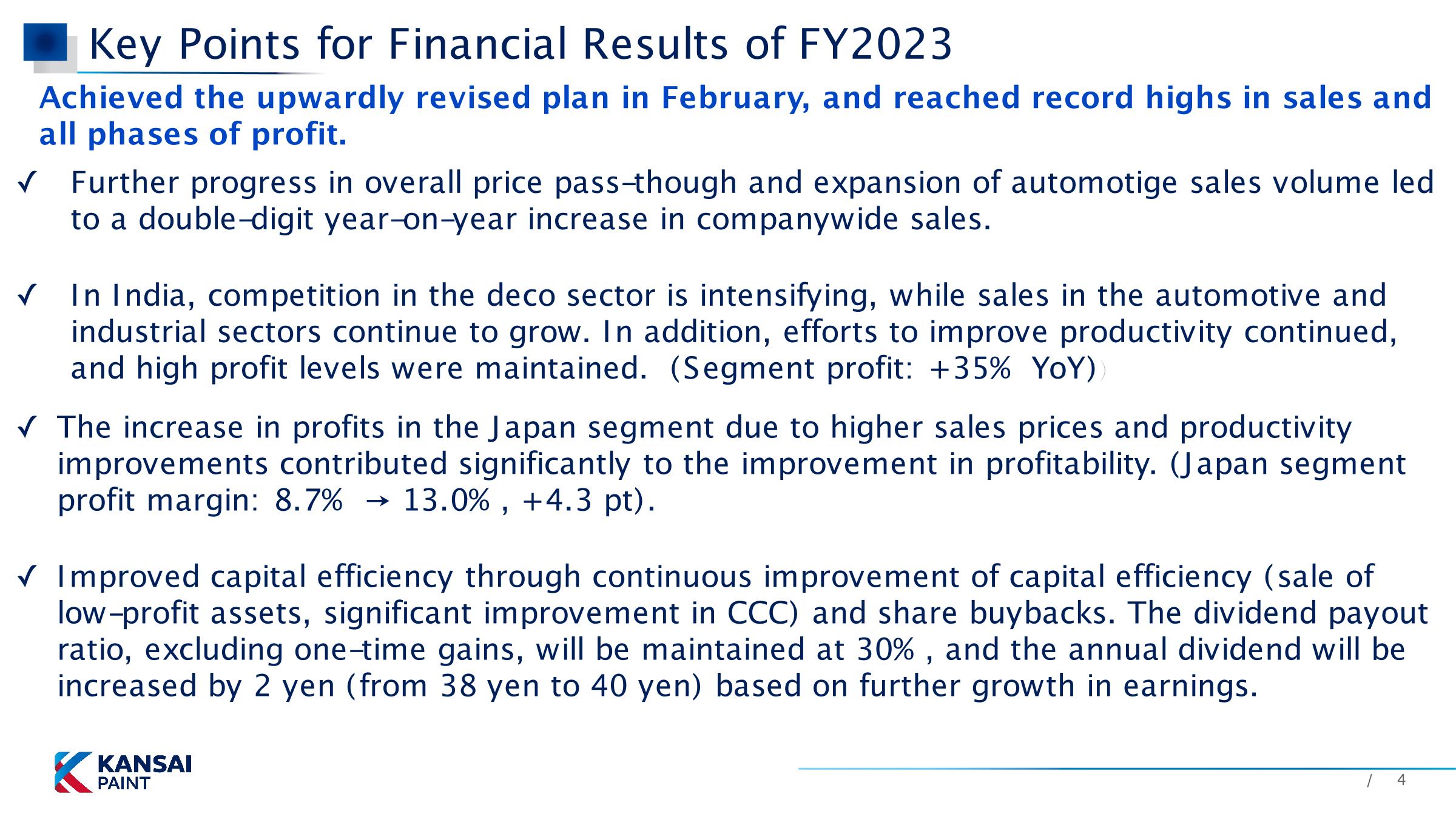

Key Points for Financial Results of FY2023

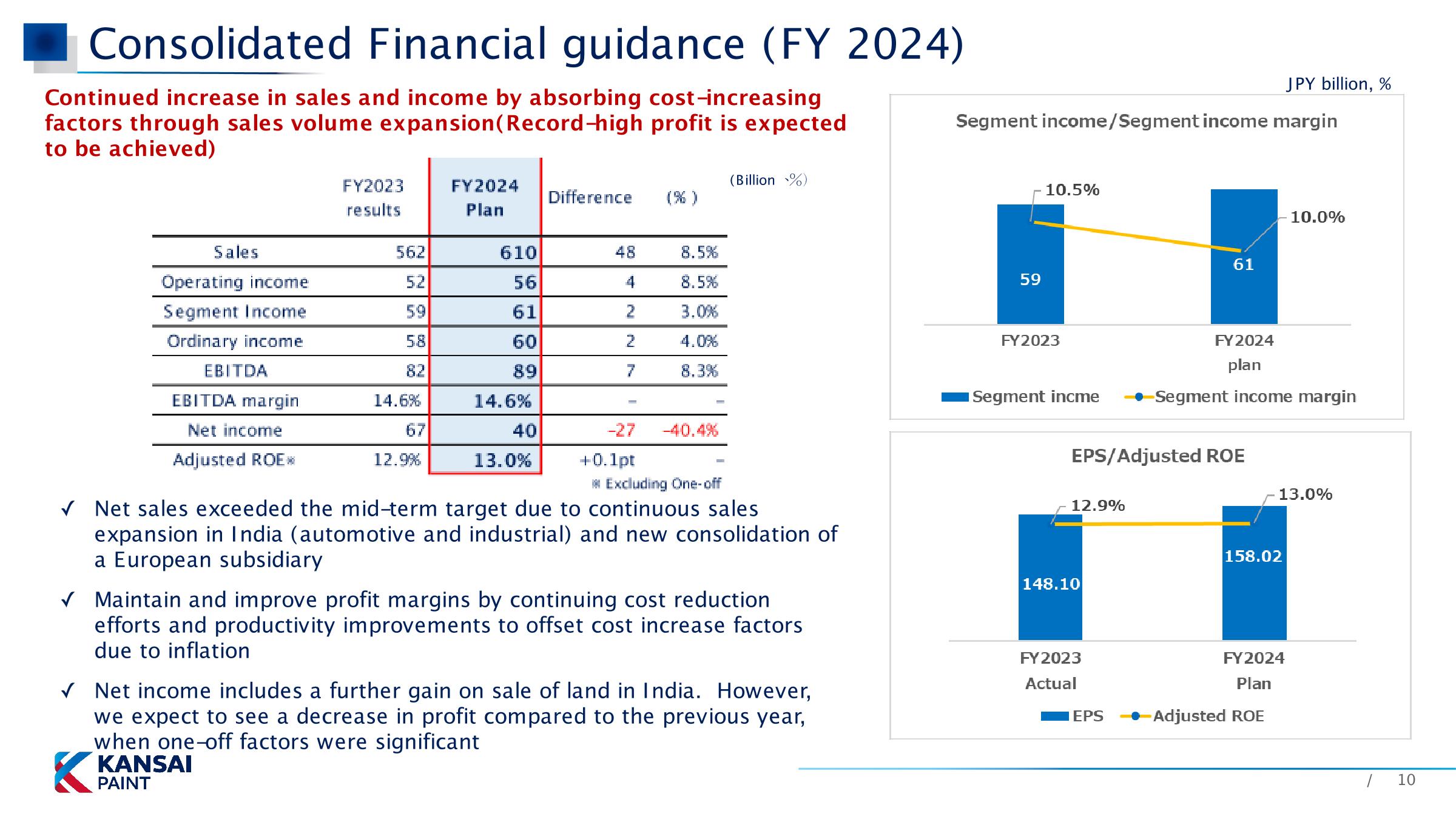

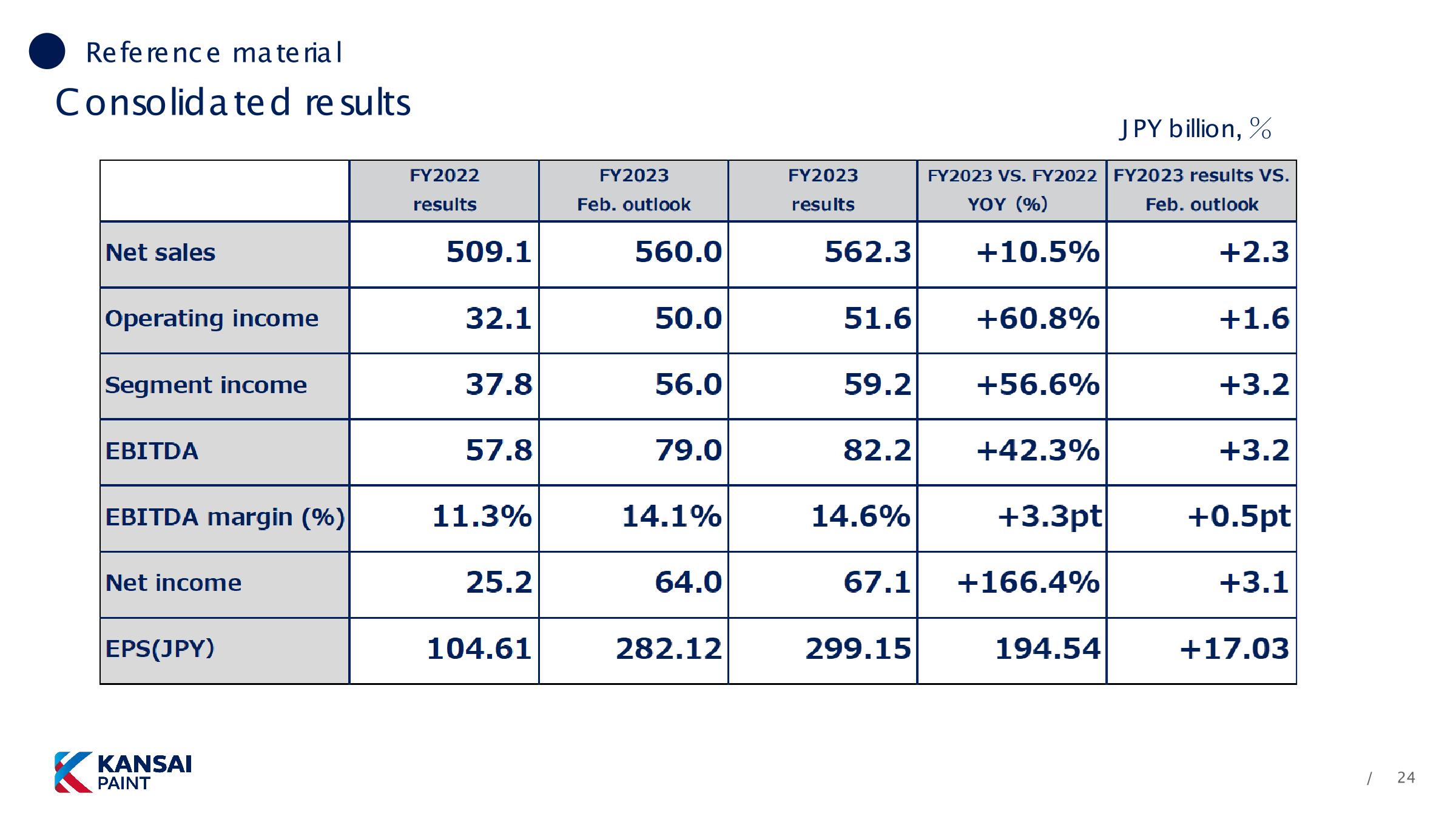

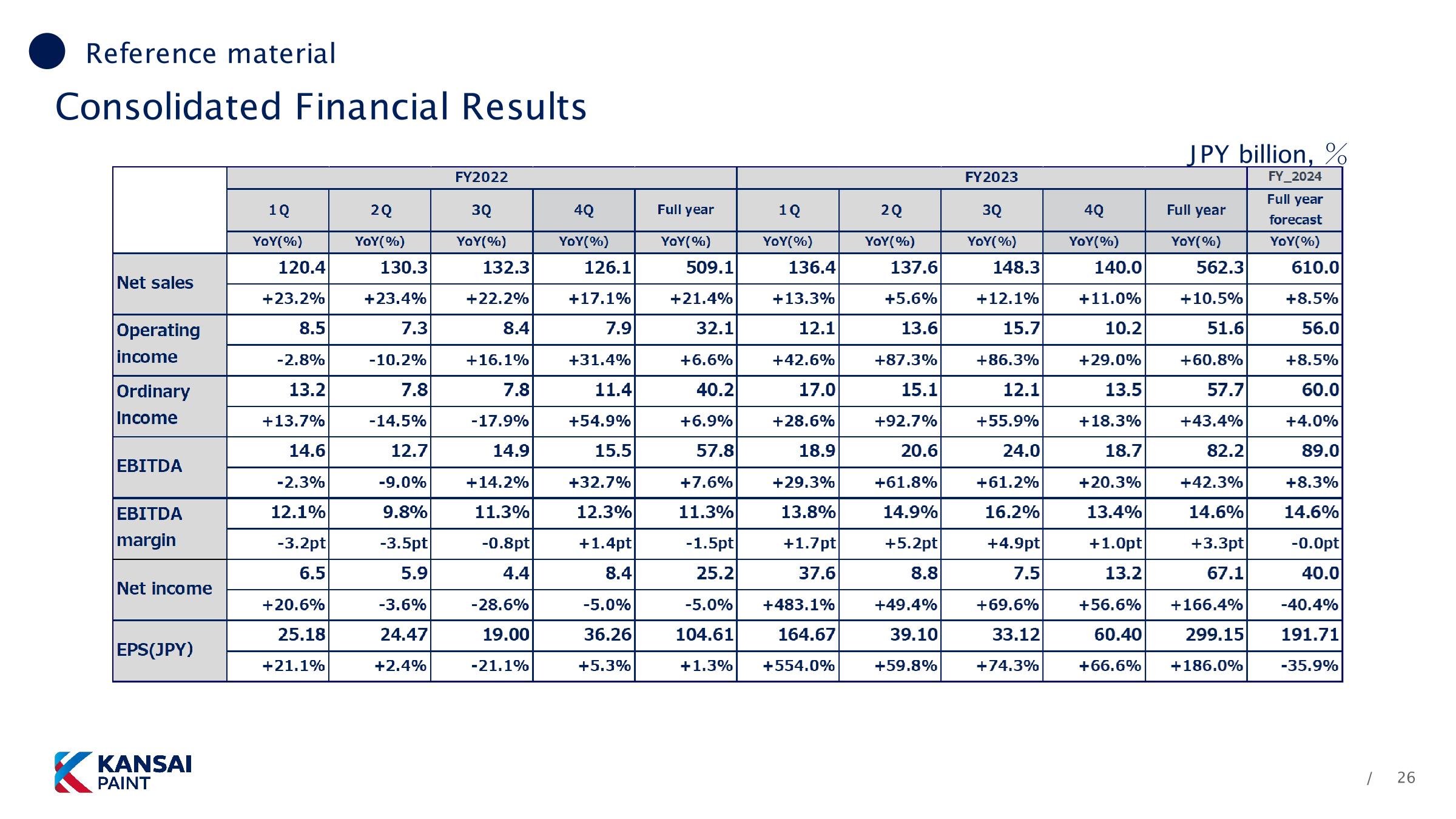

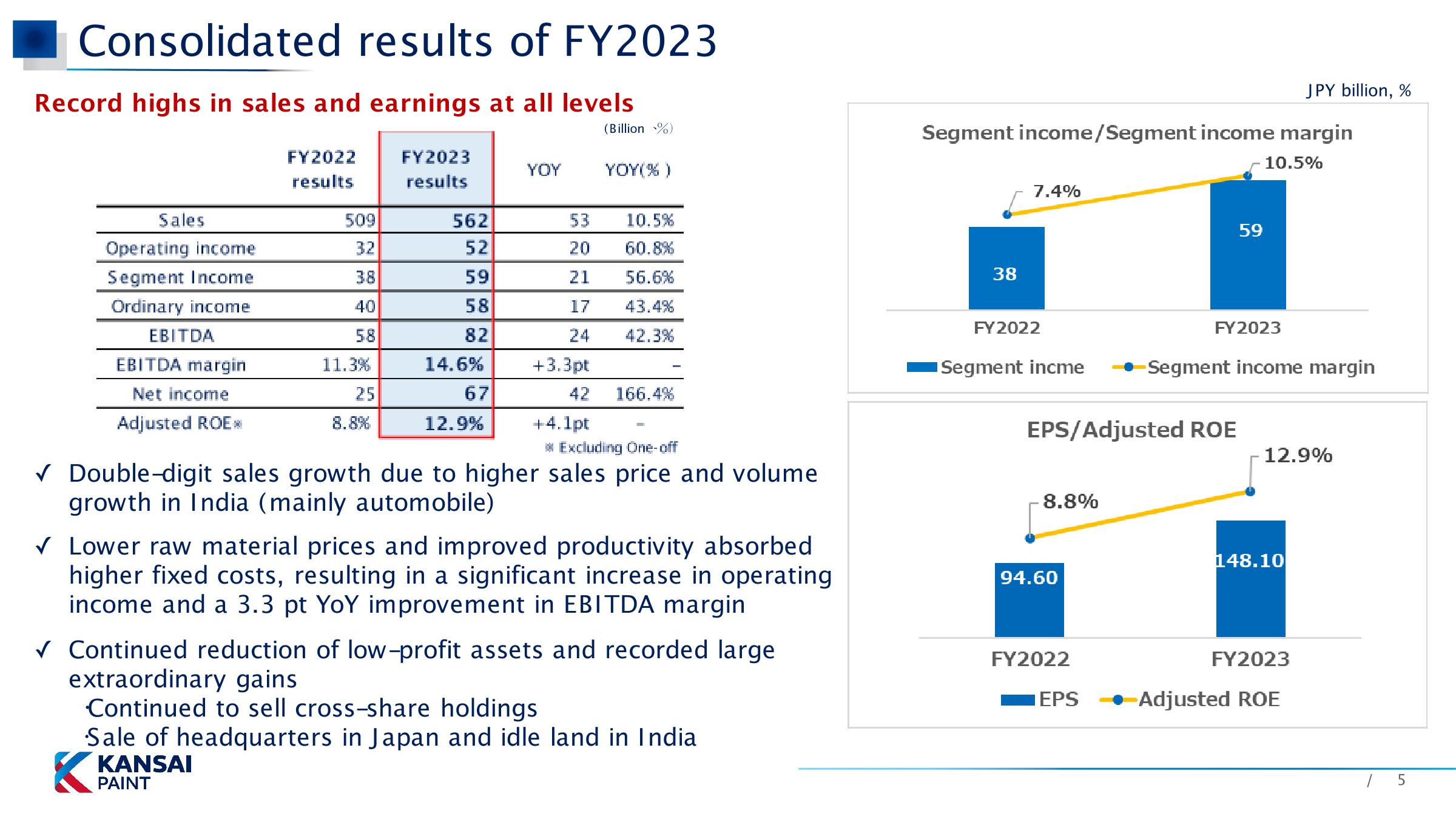

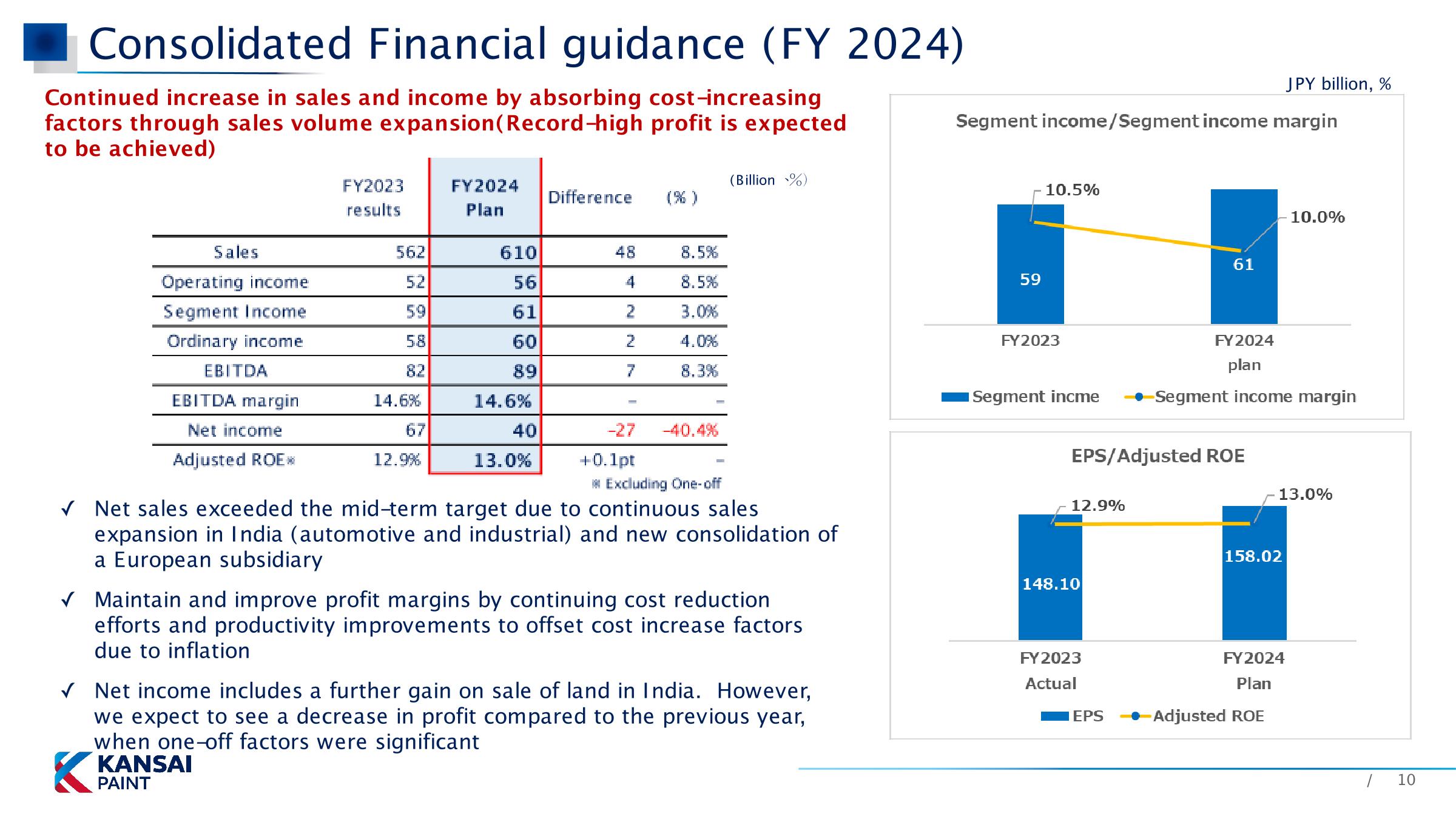

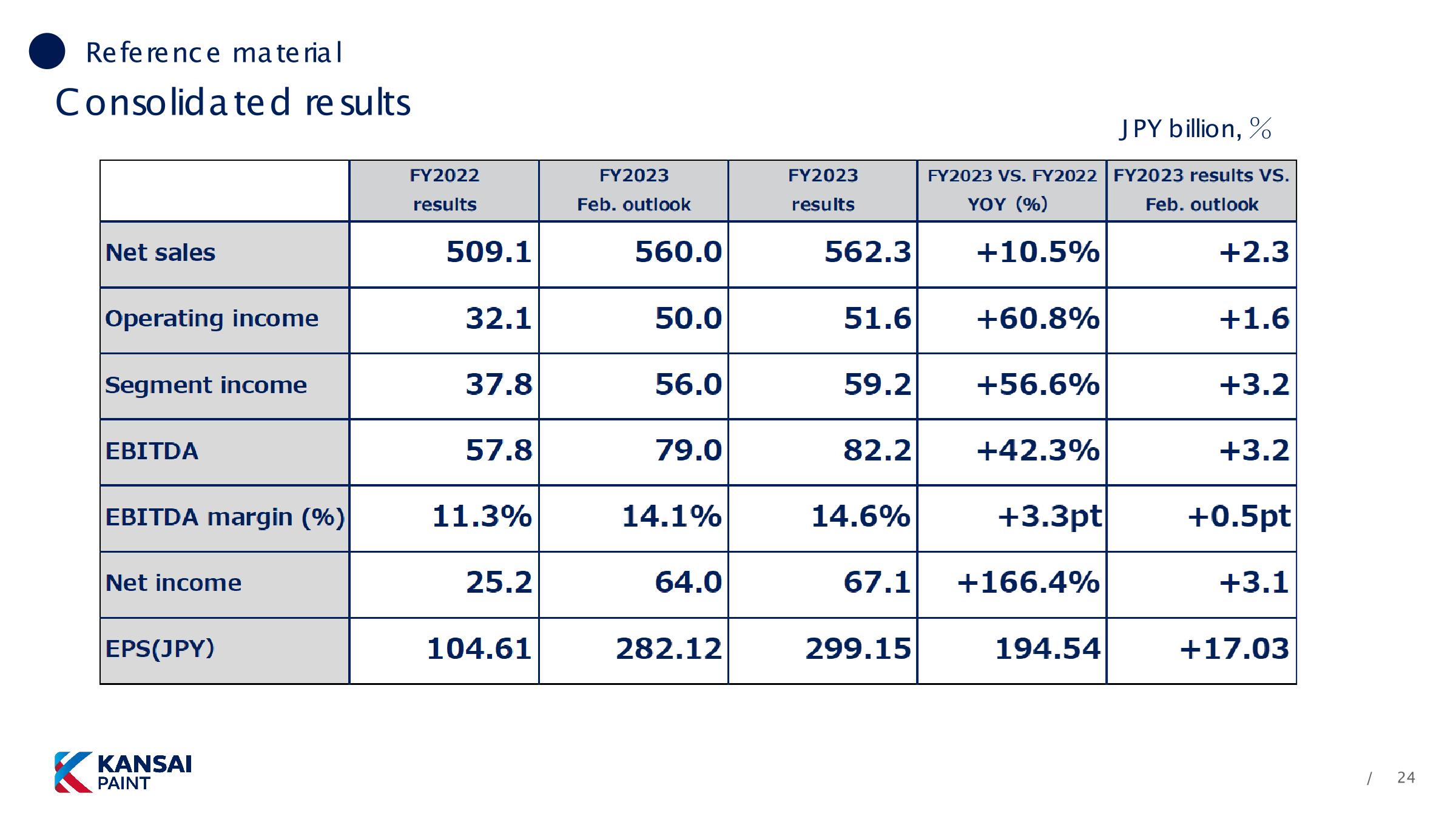

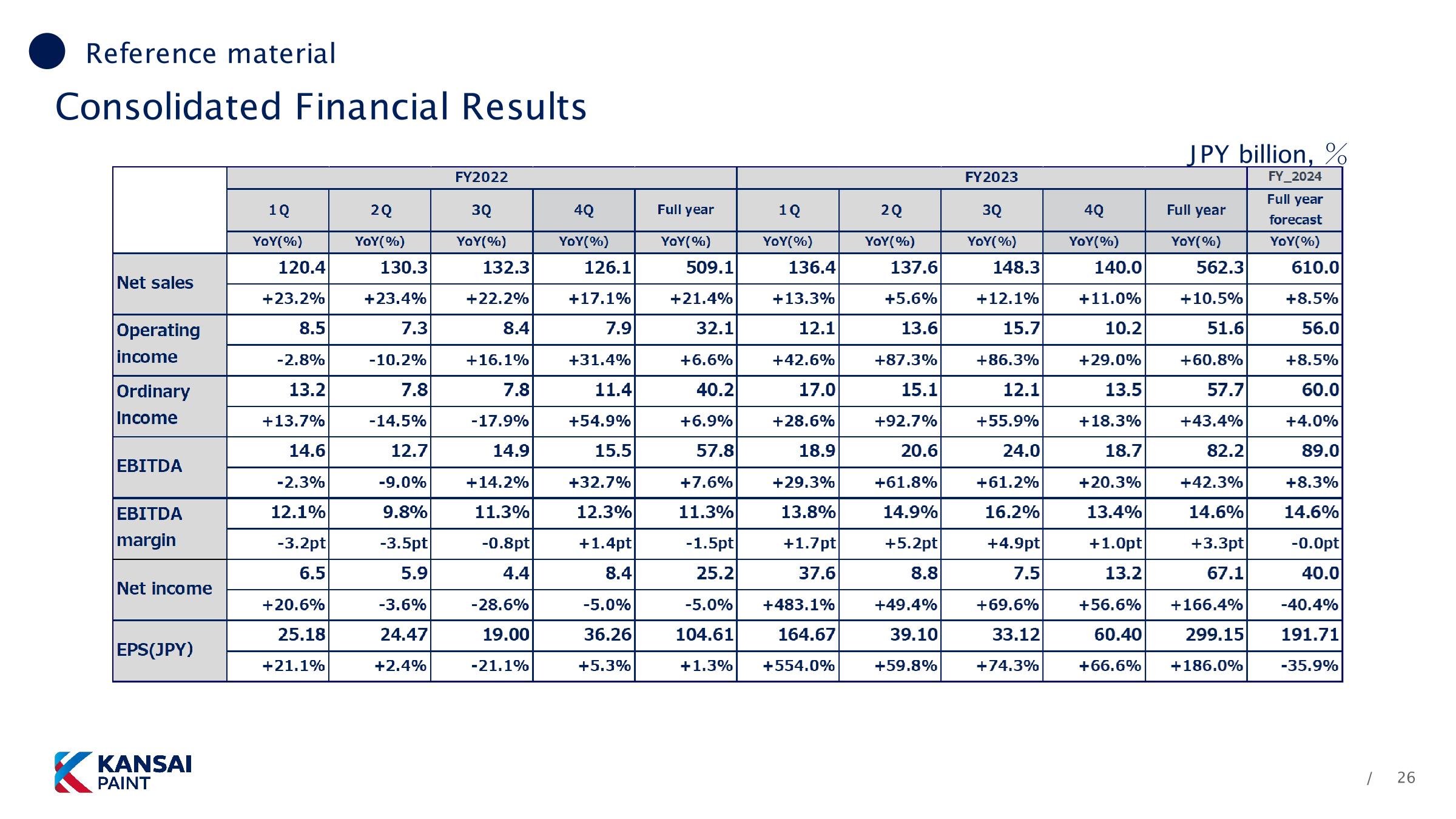

Achieved the upwardly revised plan in February, and reached record highs in sales andall phases of profit.

?

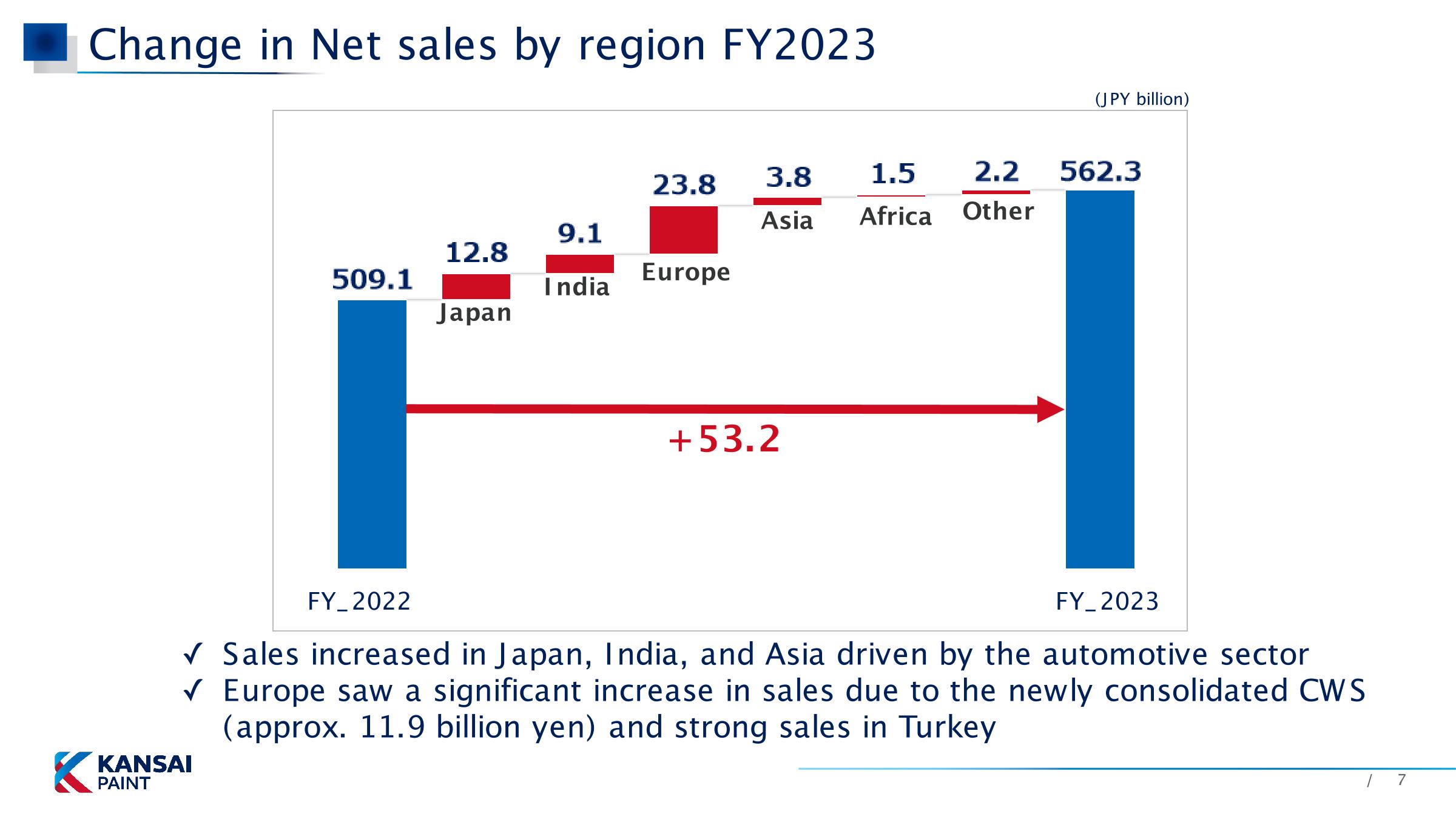

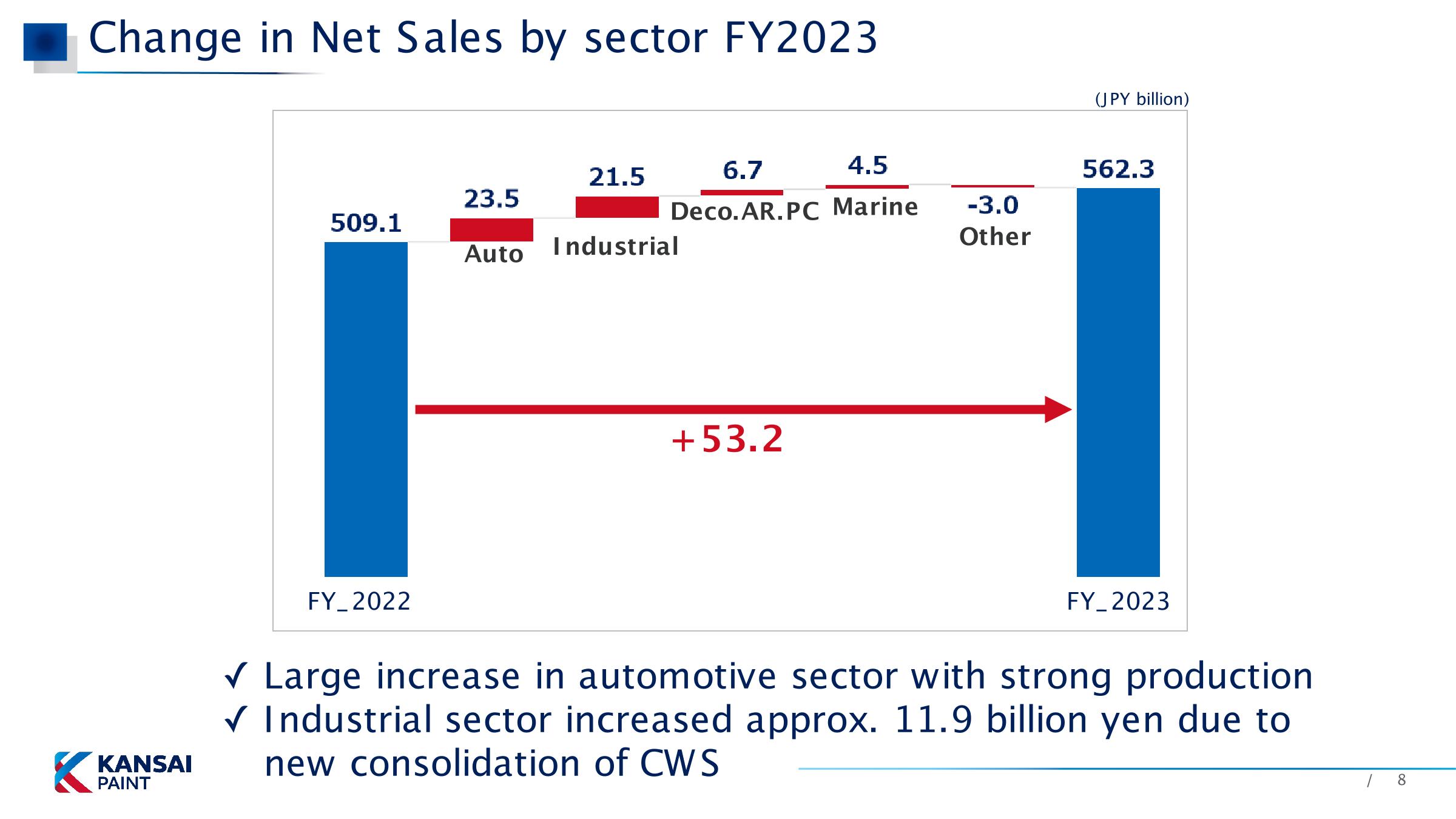

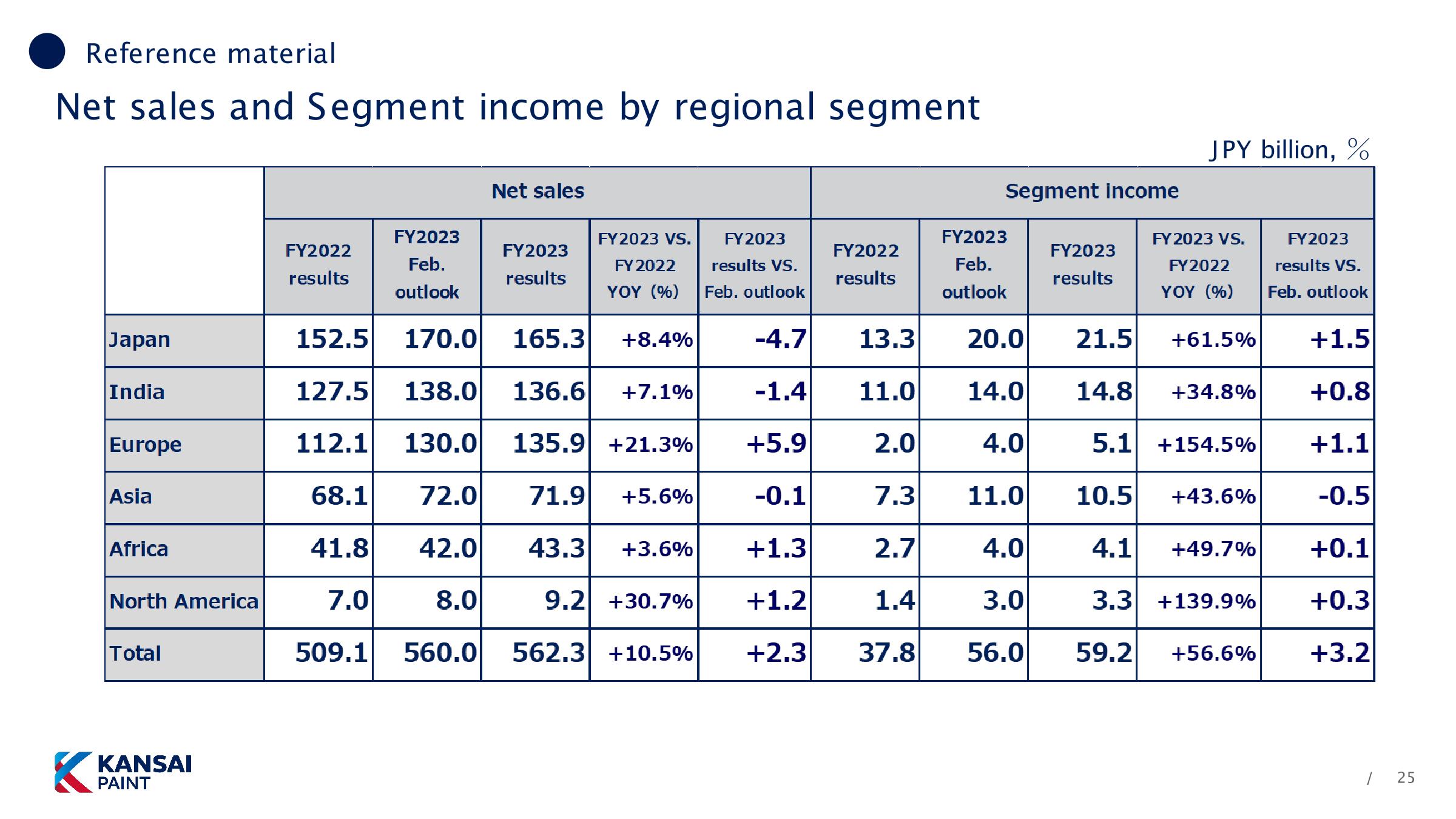

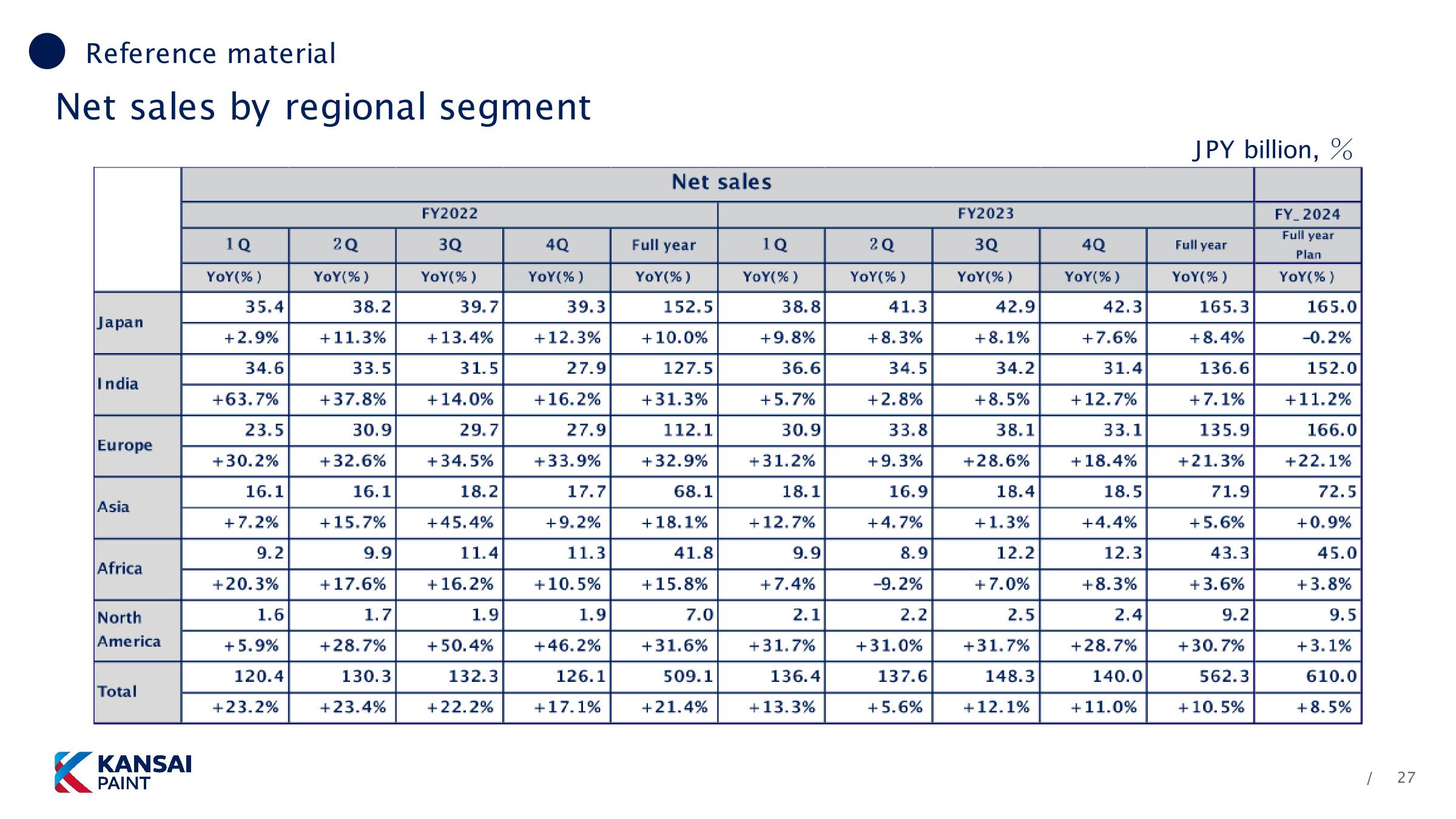

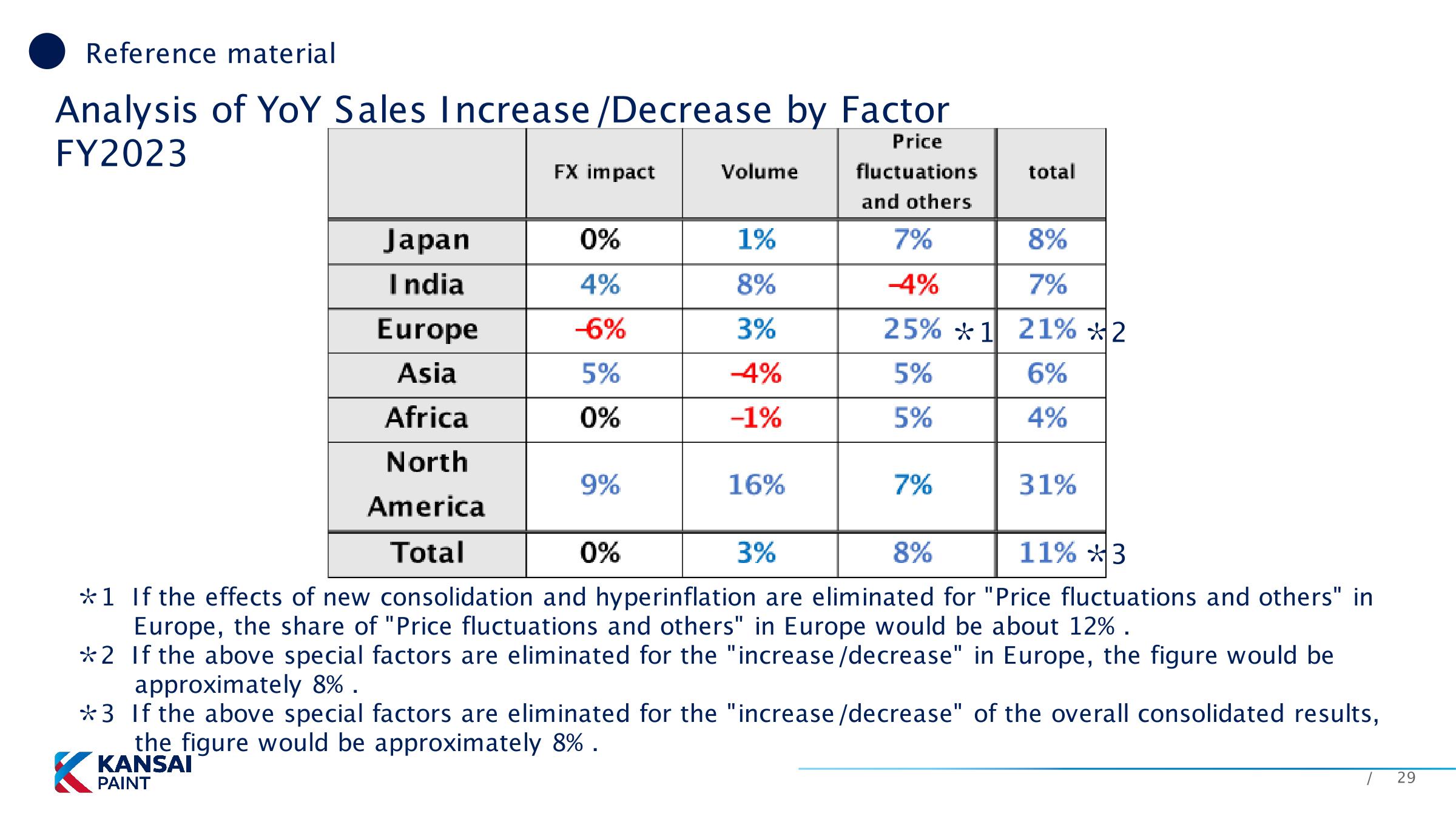

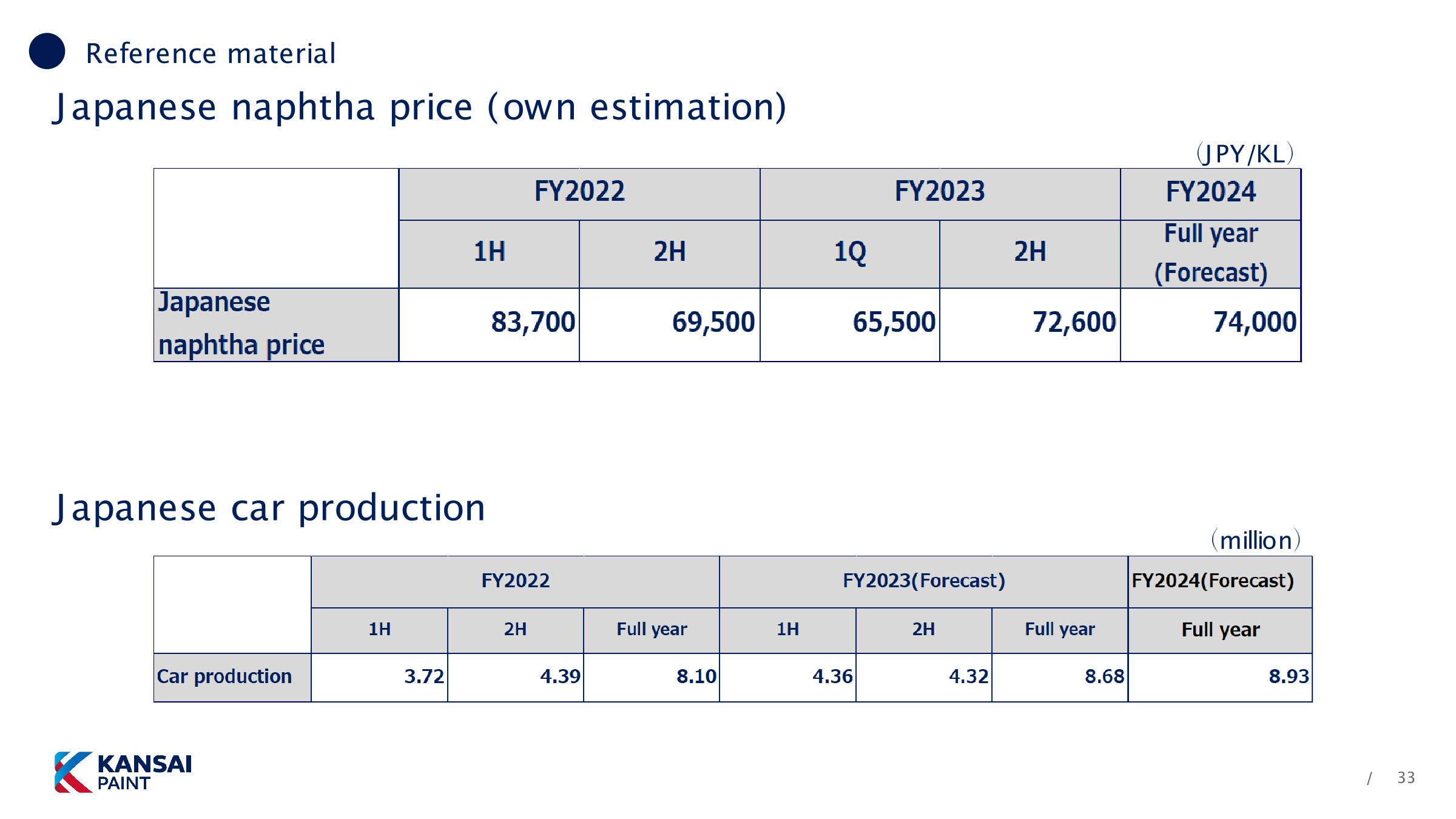

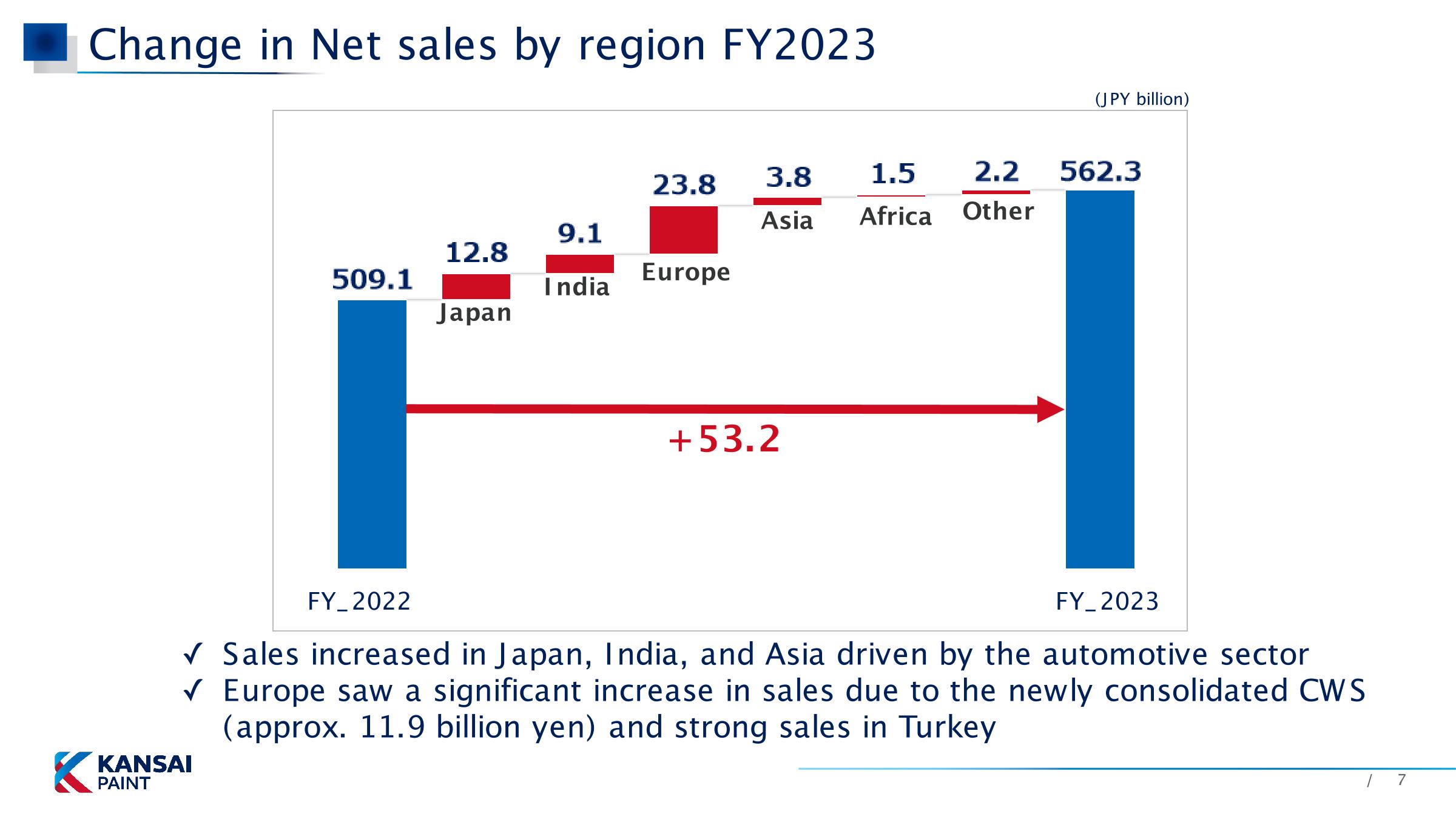

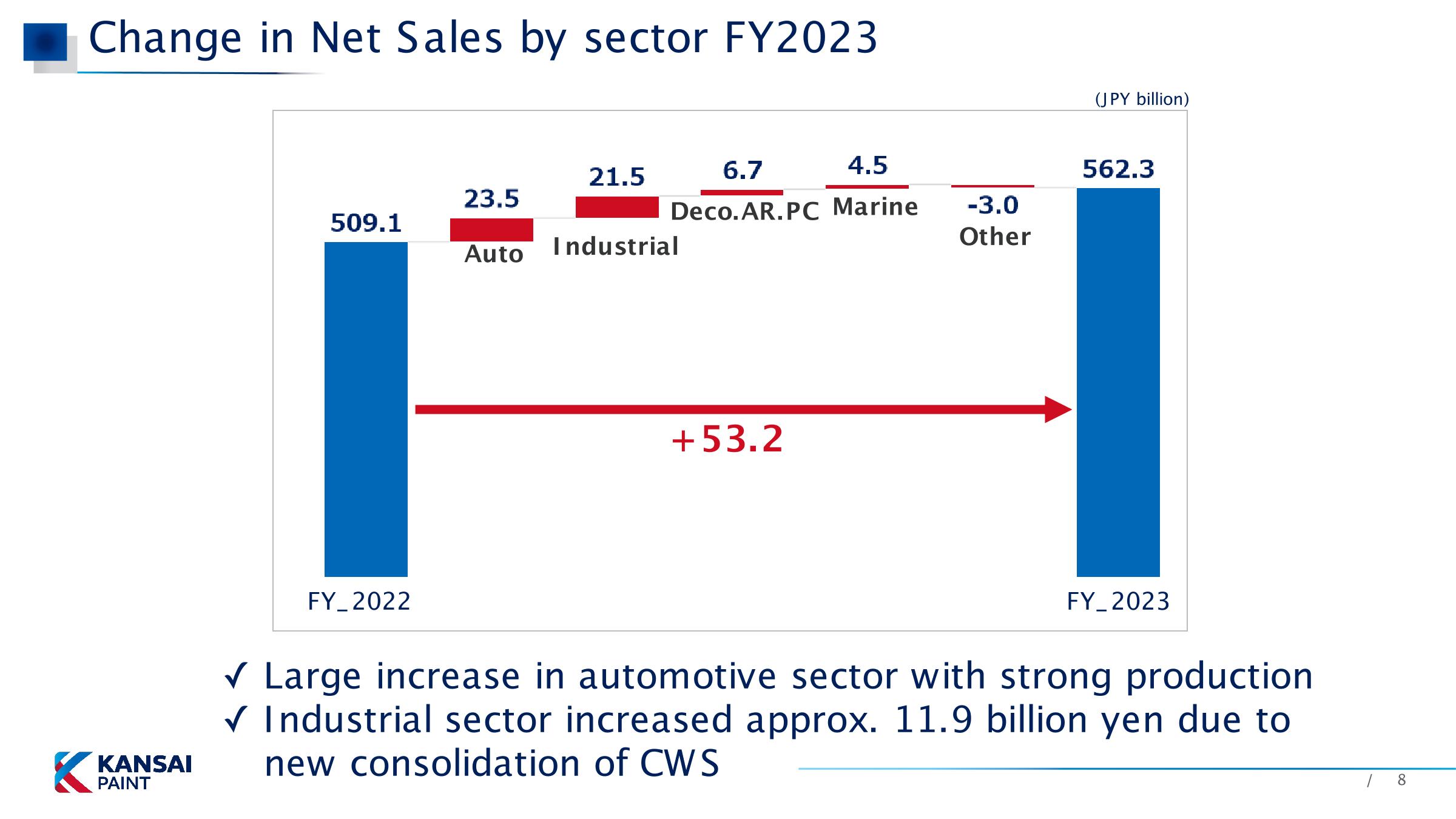

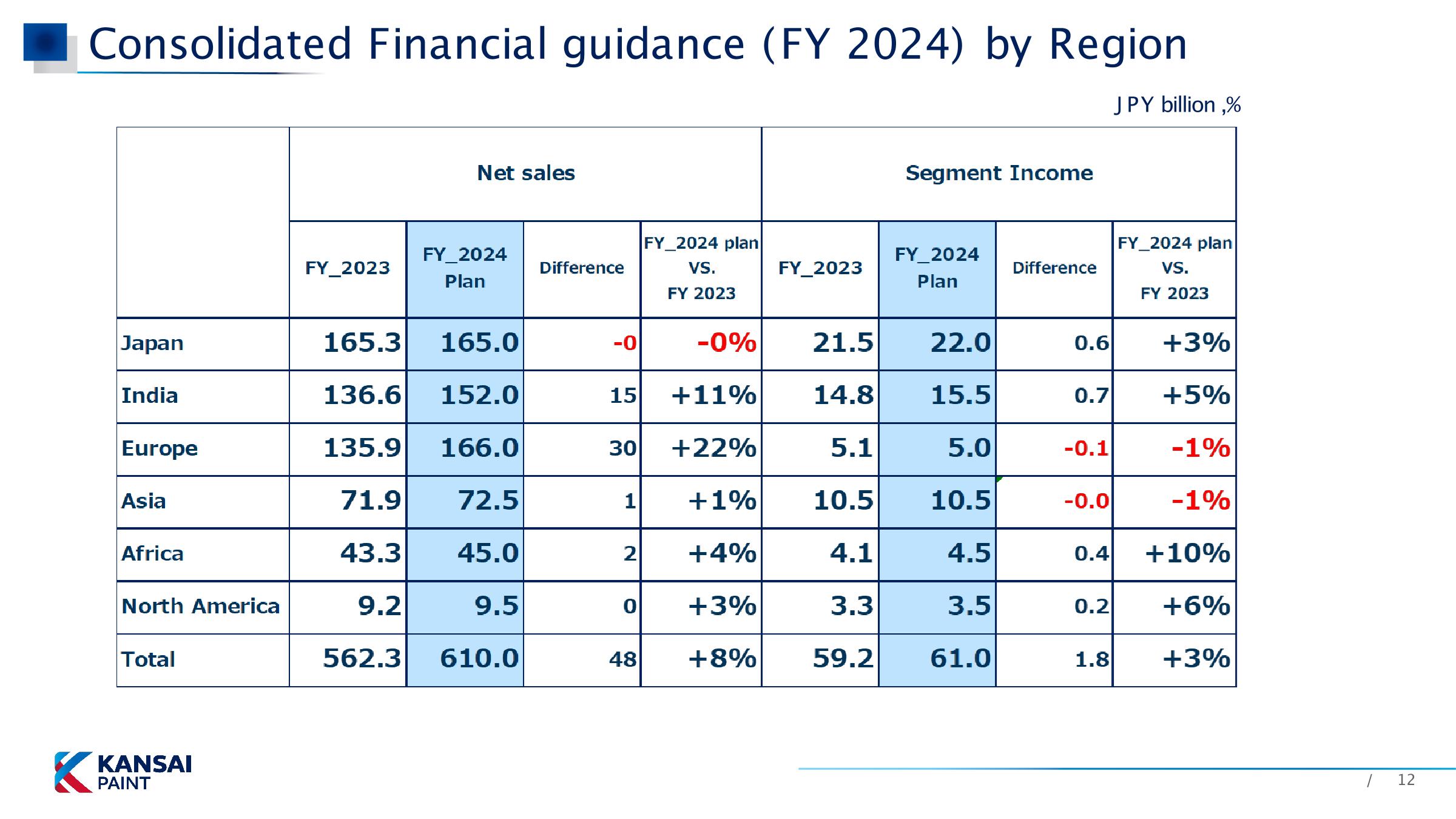

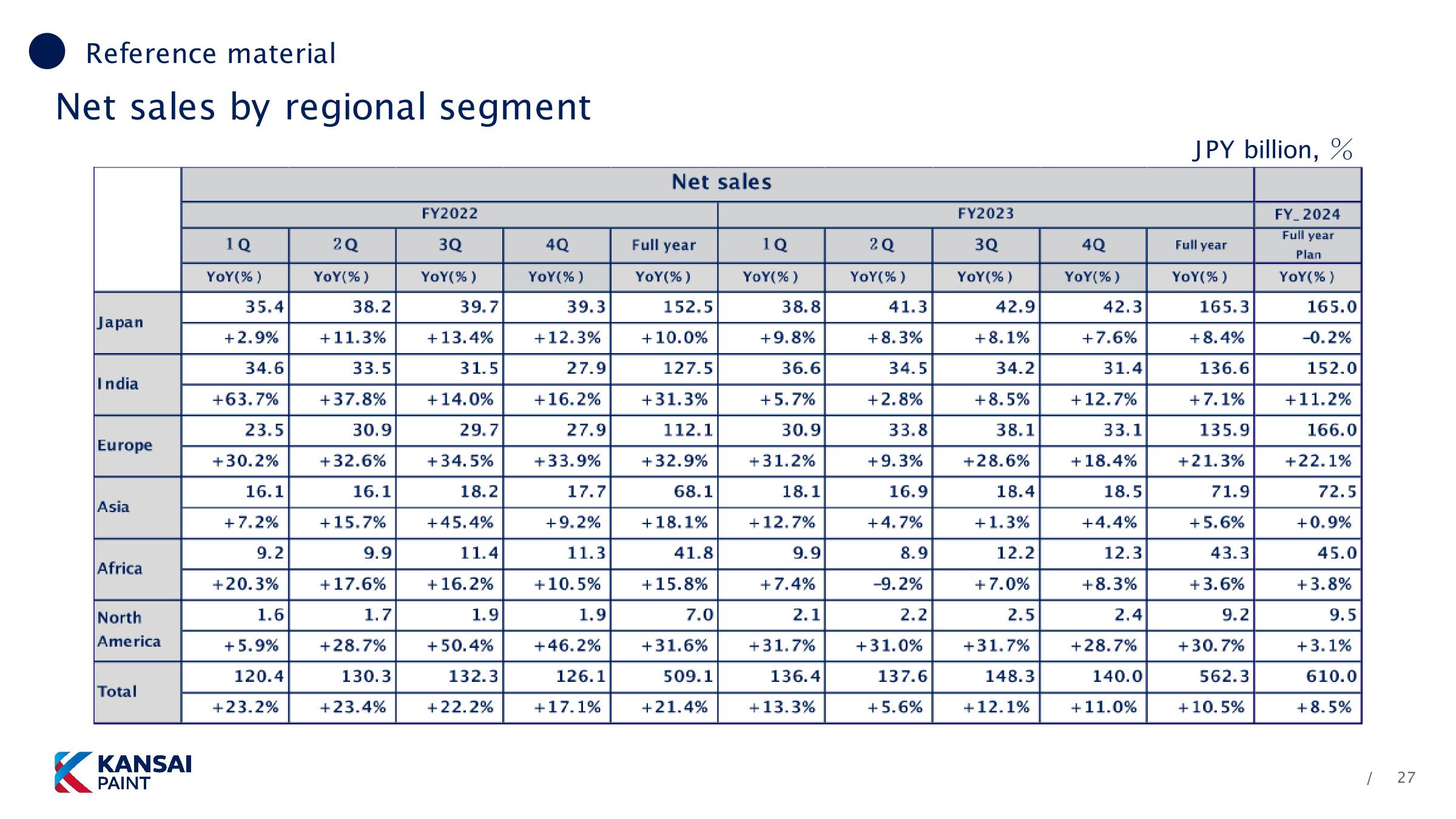

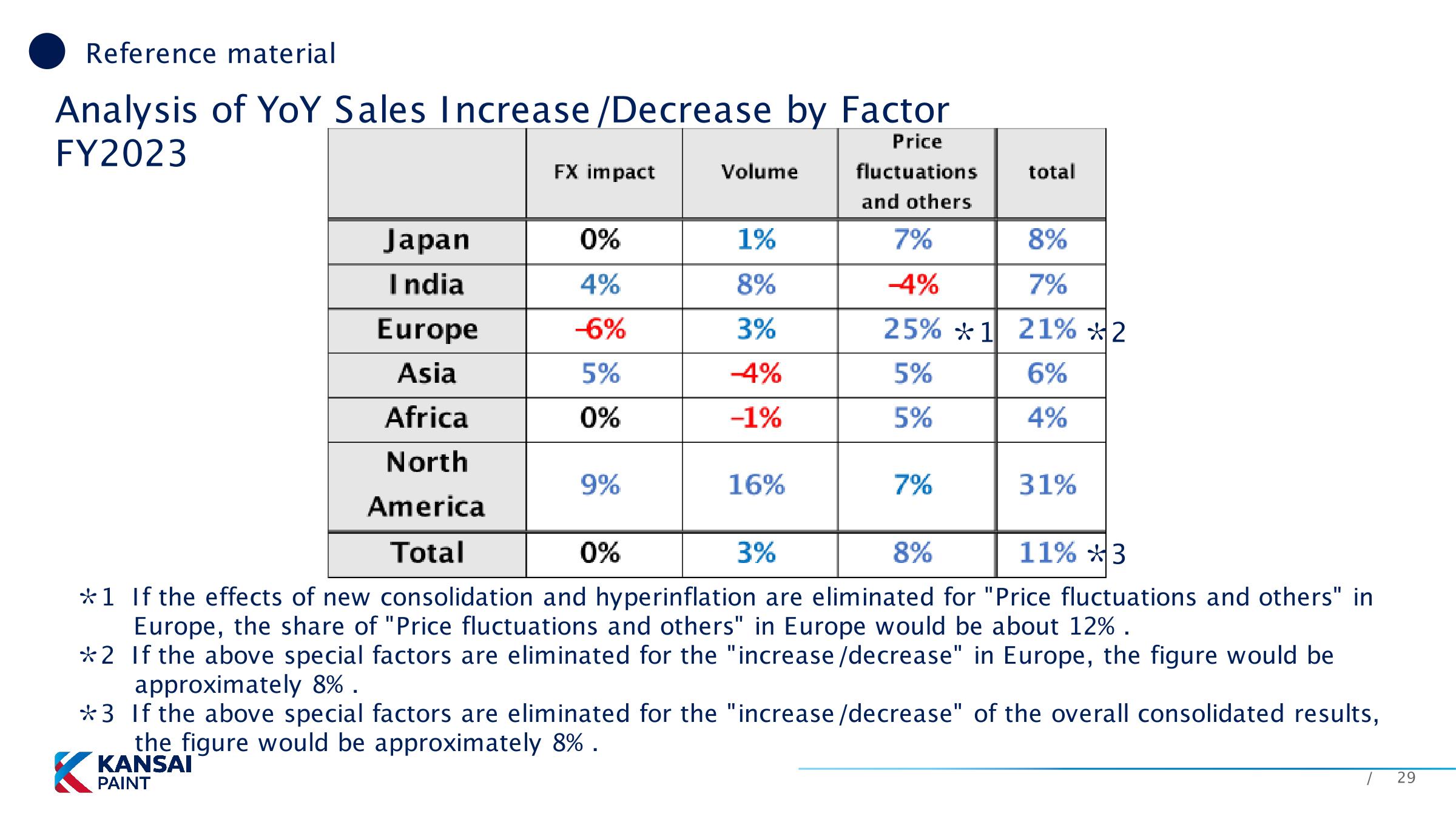

Further progress in overall price pass-though and expansion of automotige sales volume led to a double-digit year-on-year increase in companywide sales.

?

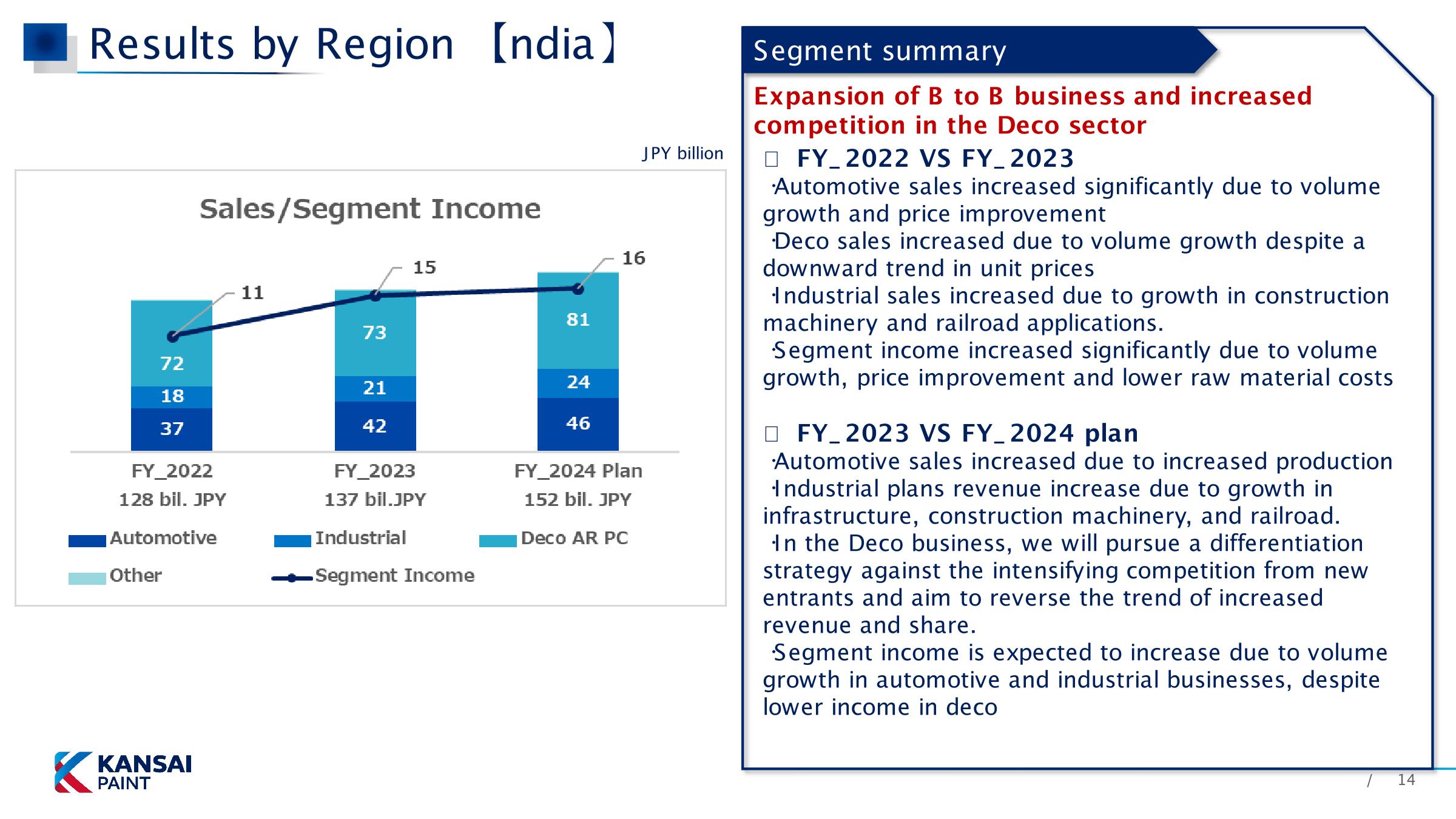

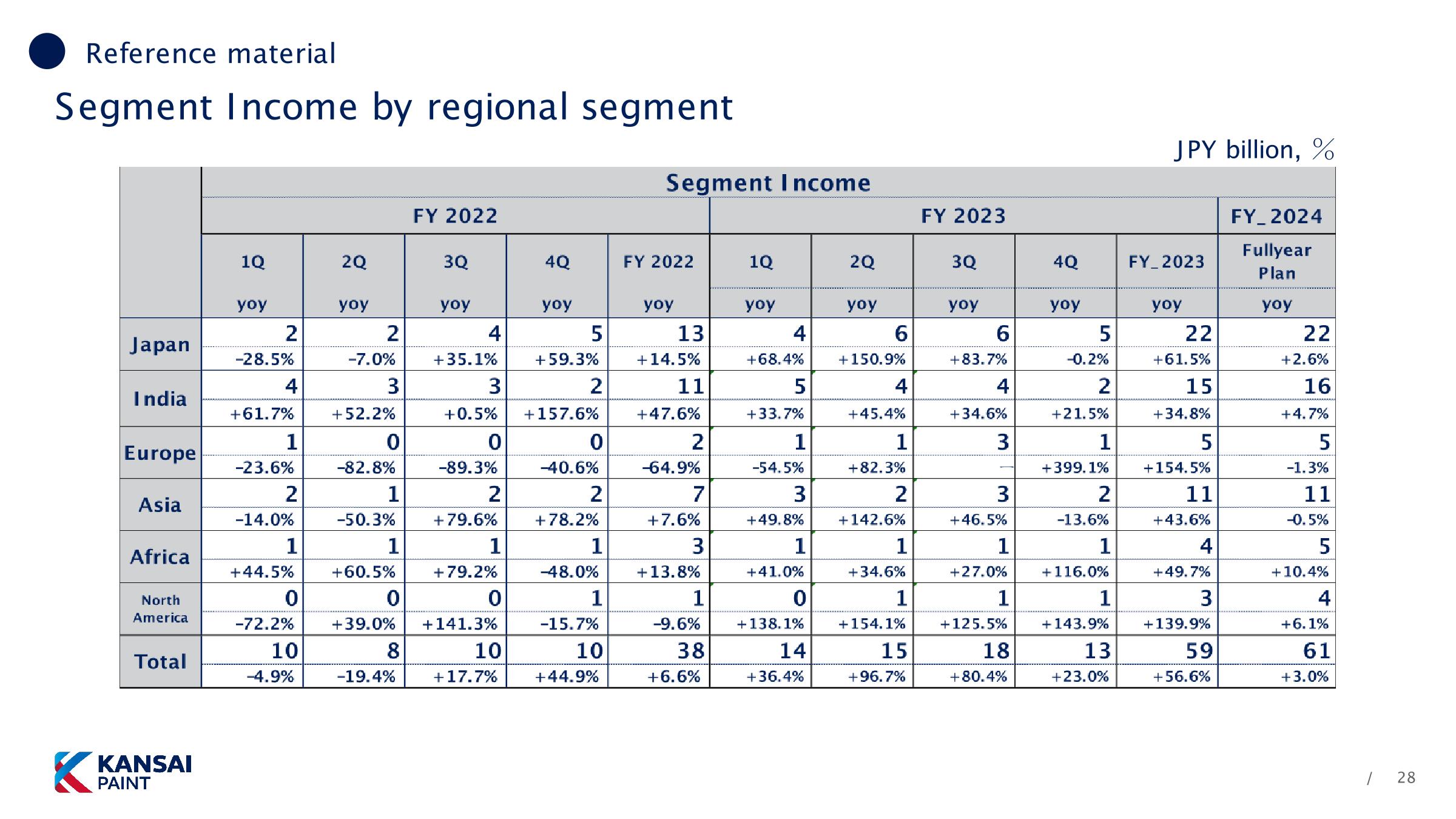

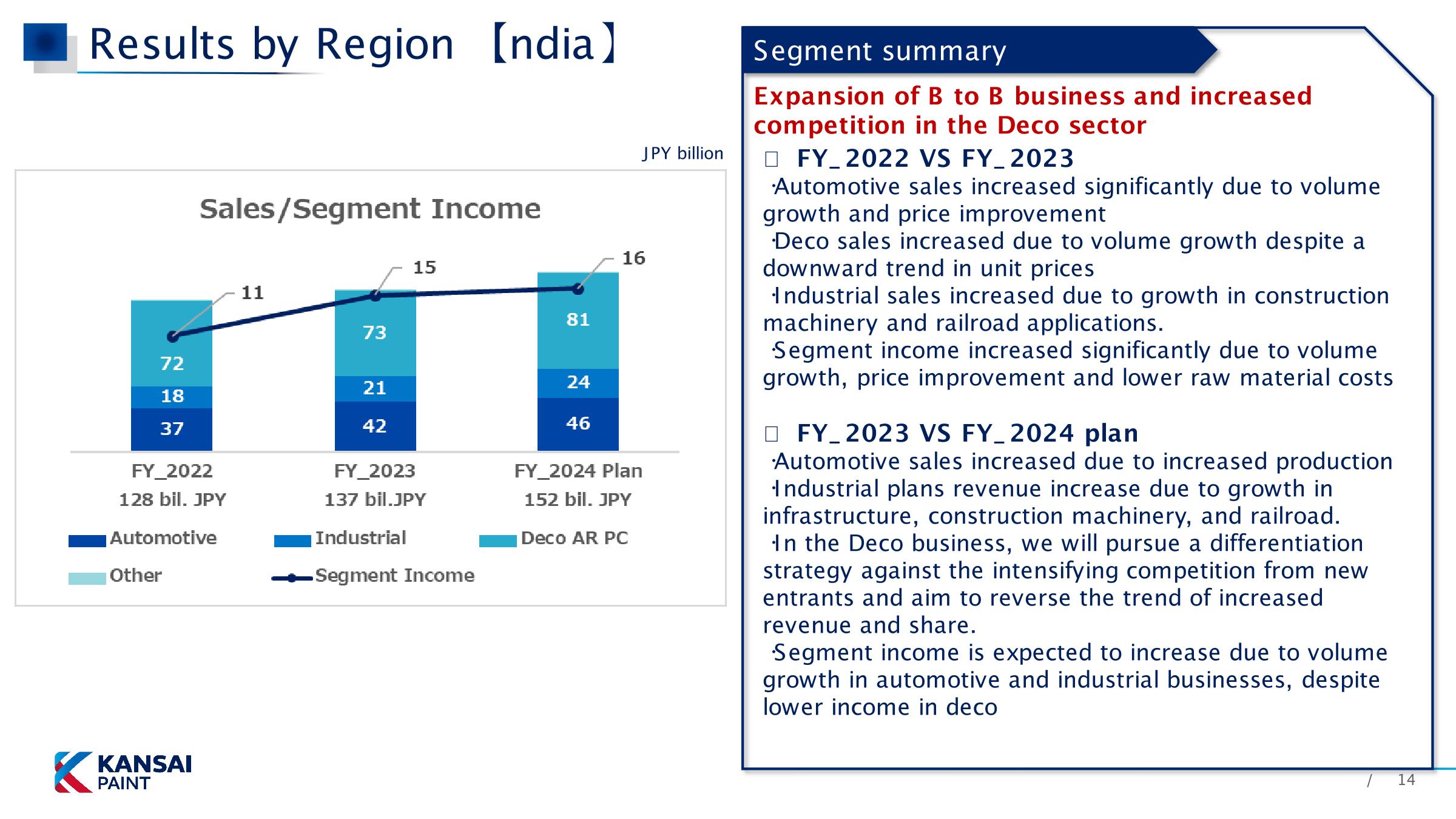

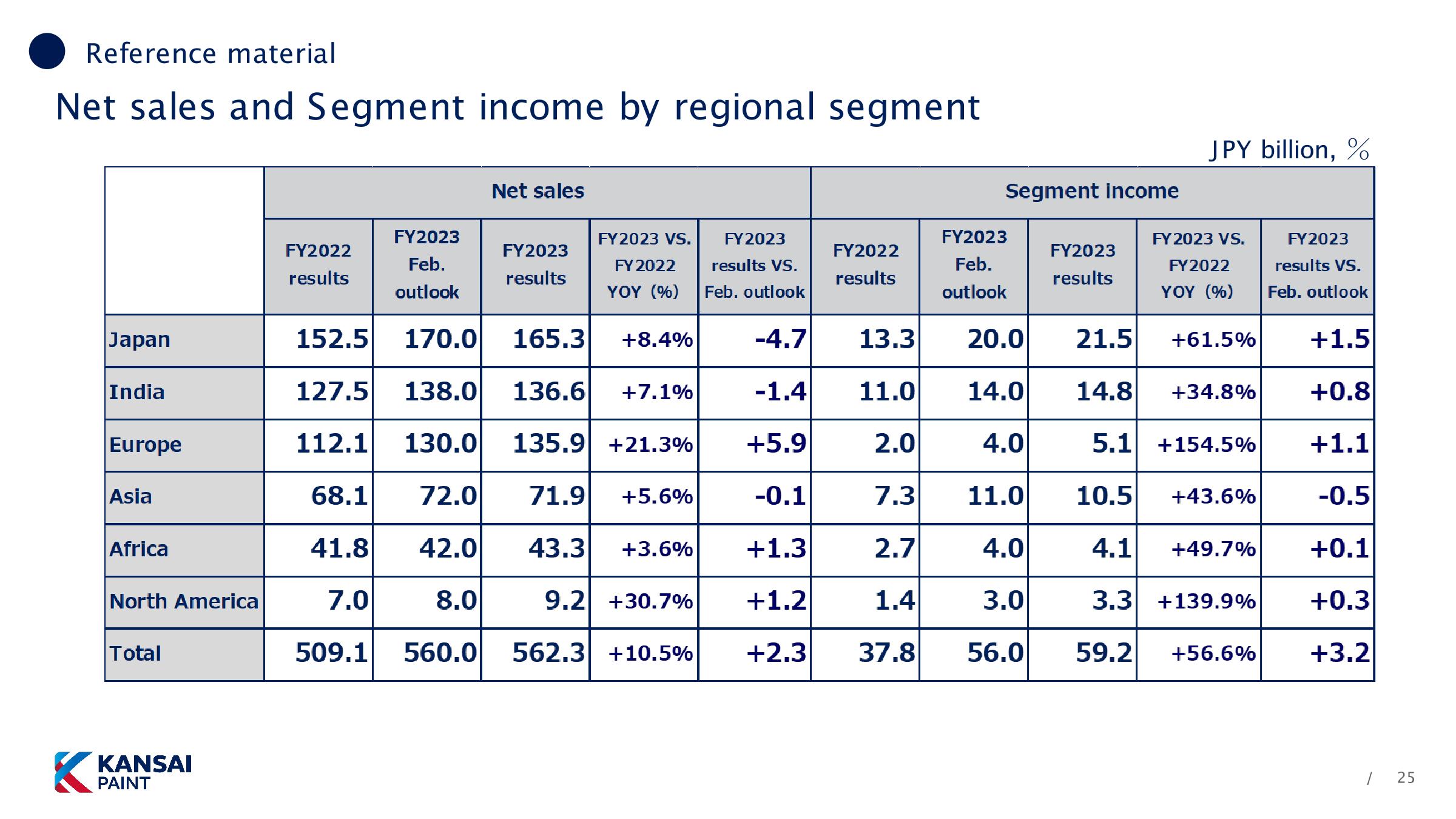

In India, competition in the deco sector is intensifying, while sales in the automotive and

industrial sectors continue to grow.

In addition, efforts to improve productivity continued,

and high profit levels were maintained.

(Segment profit: +35% YoY))

?

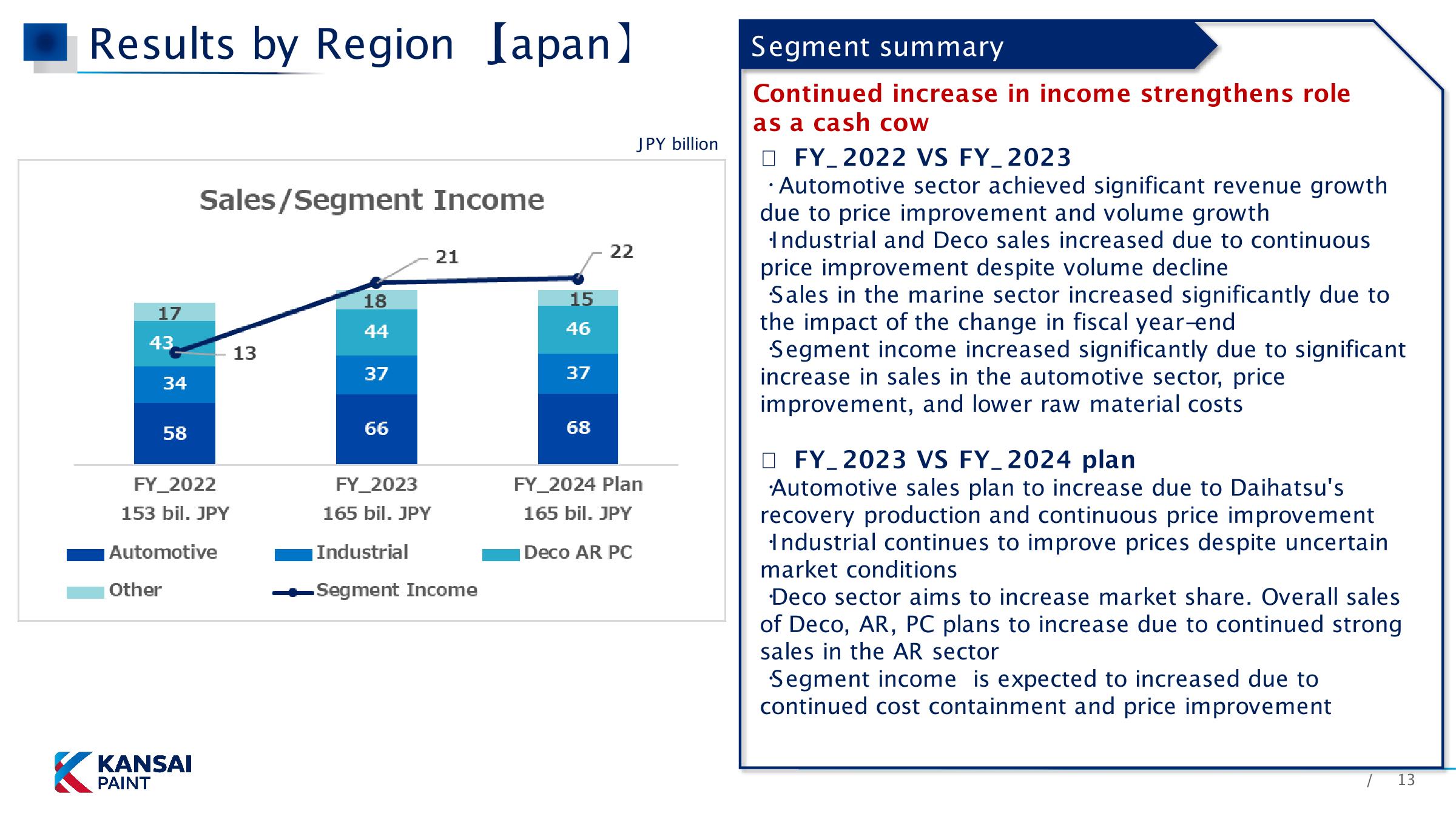

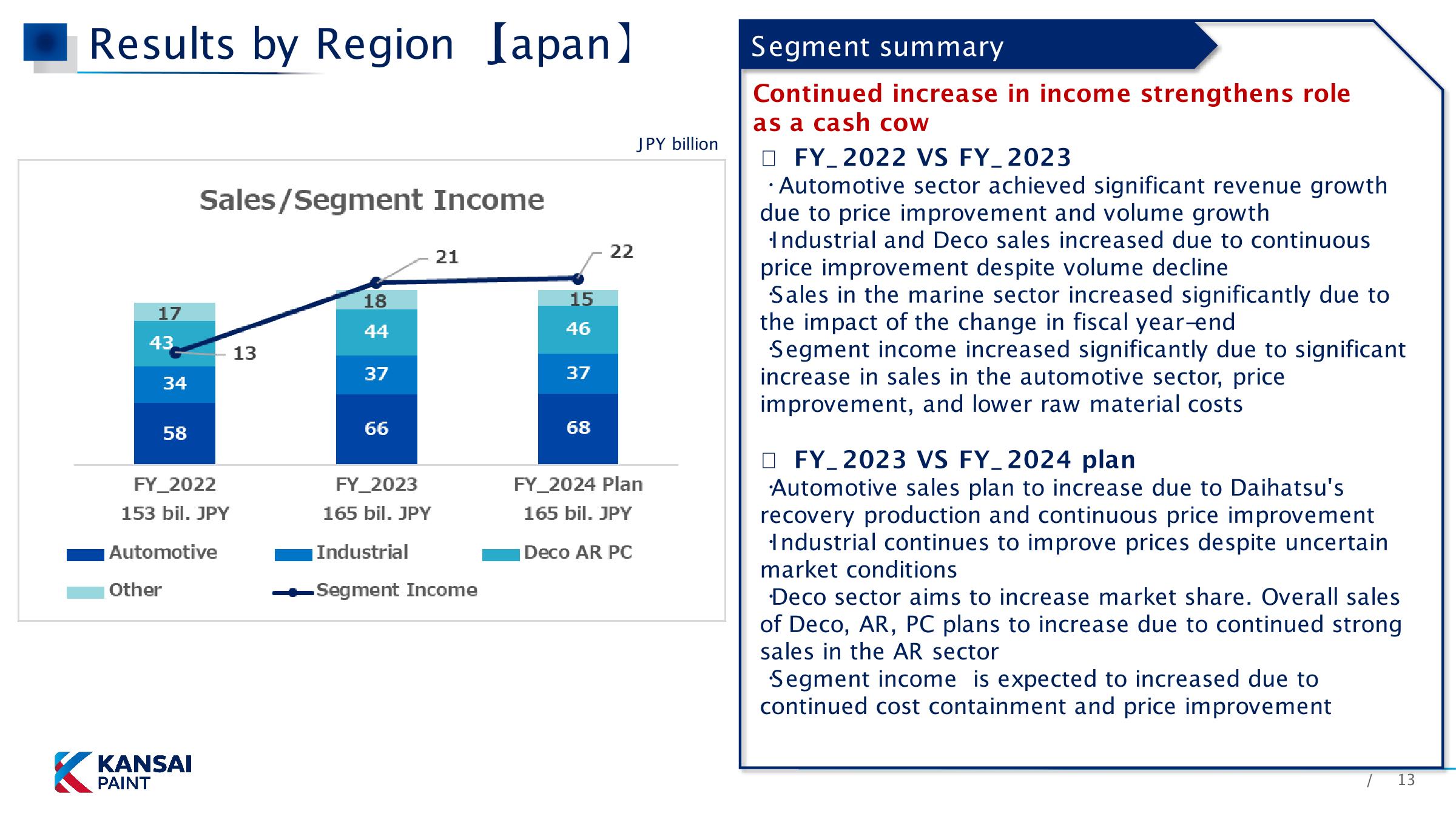

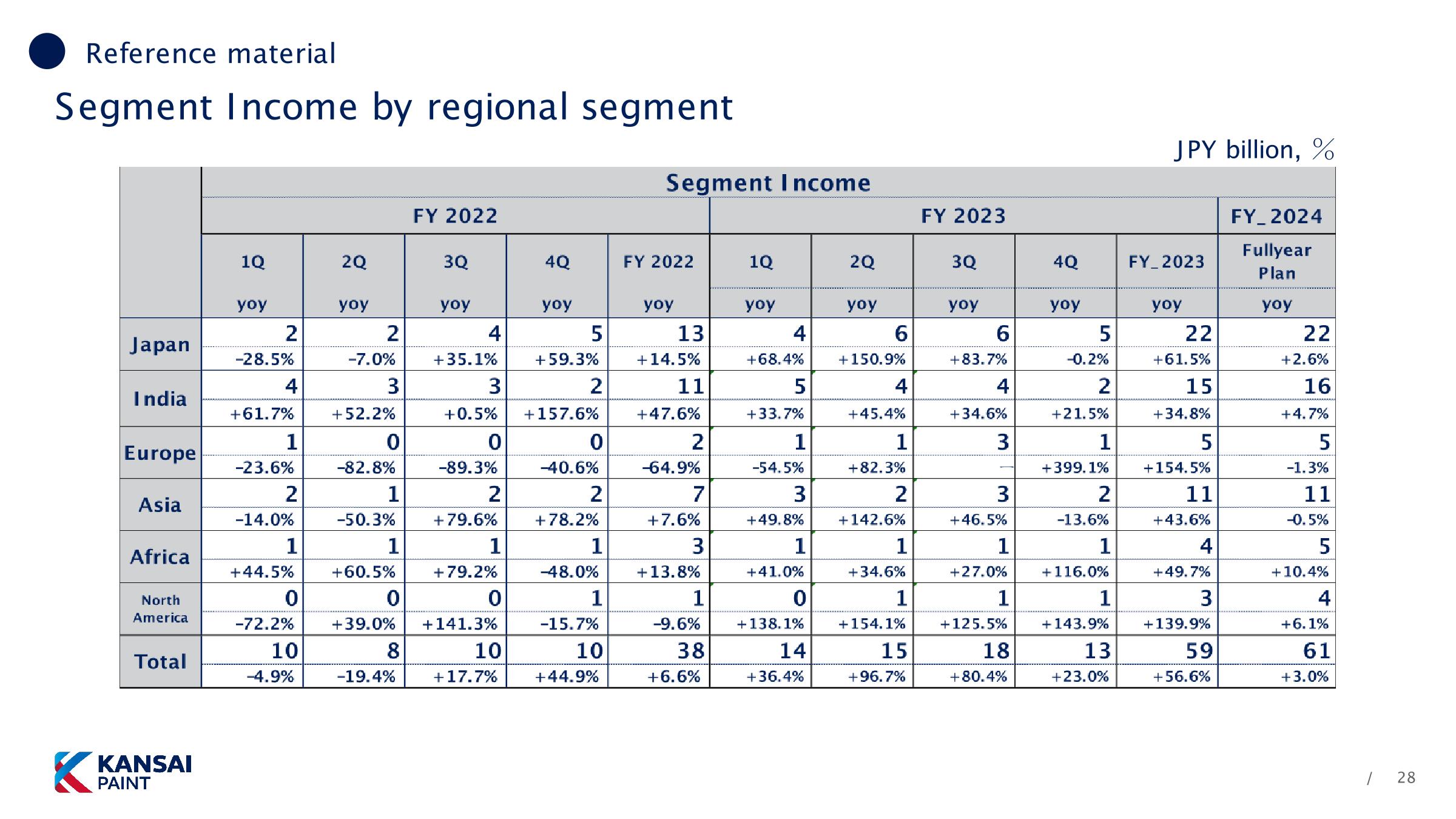

The increase in profits in the Japan segment due to higher sales prices and productivity

improvements contributed significantly to the improvement in profitability.

(Japan segment

profit margin: 8.7%

→

13.0%, +4.3 pt).

?

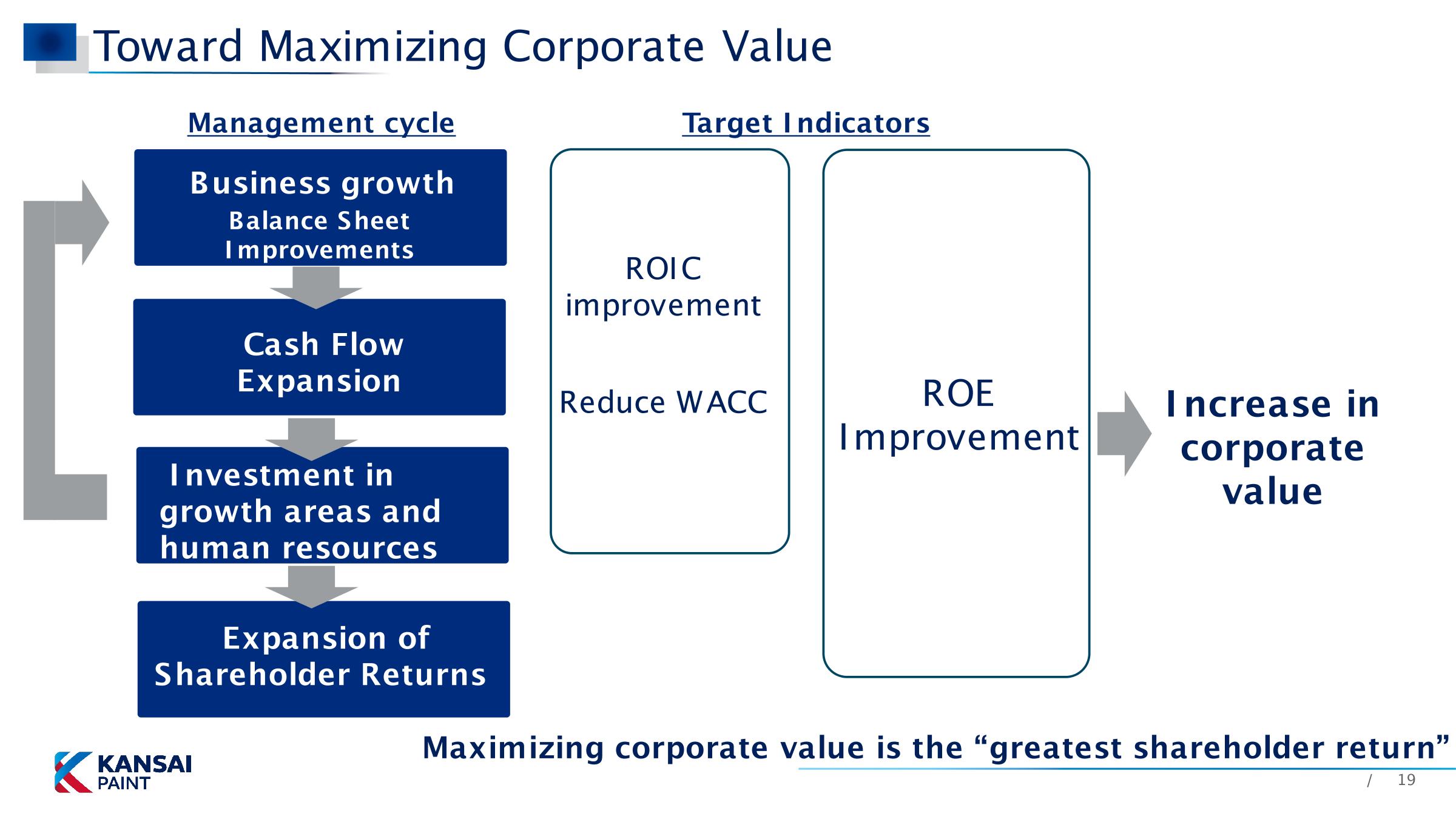

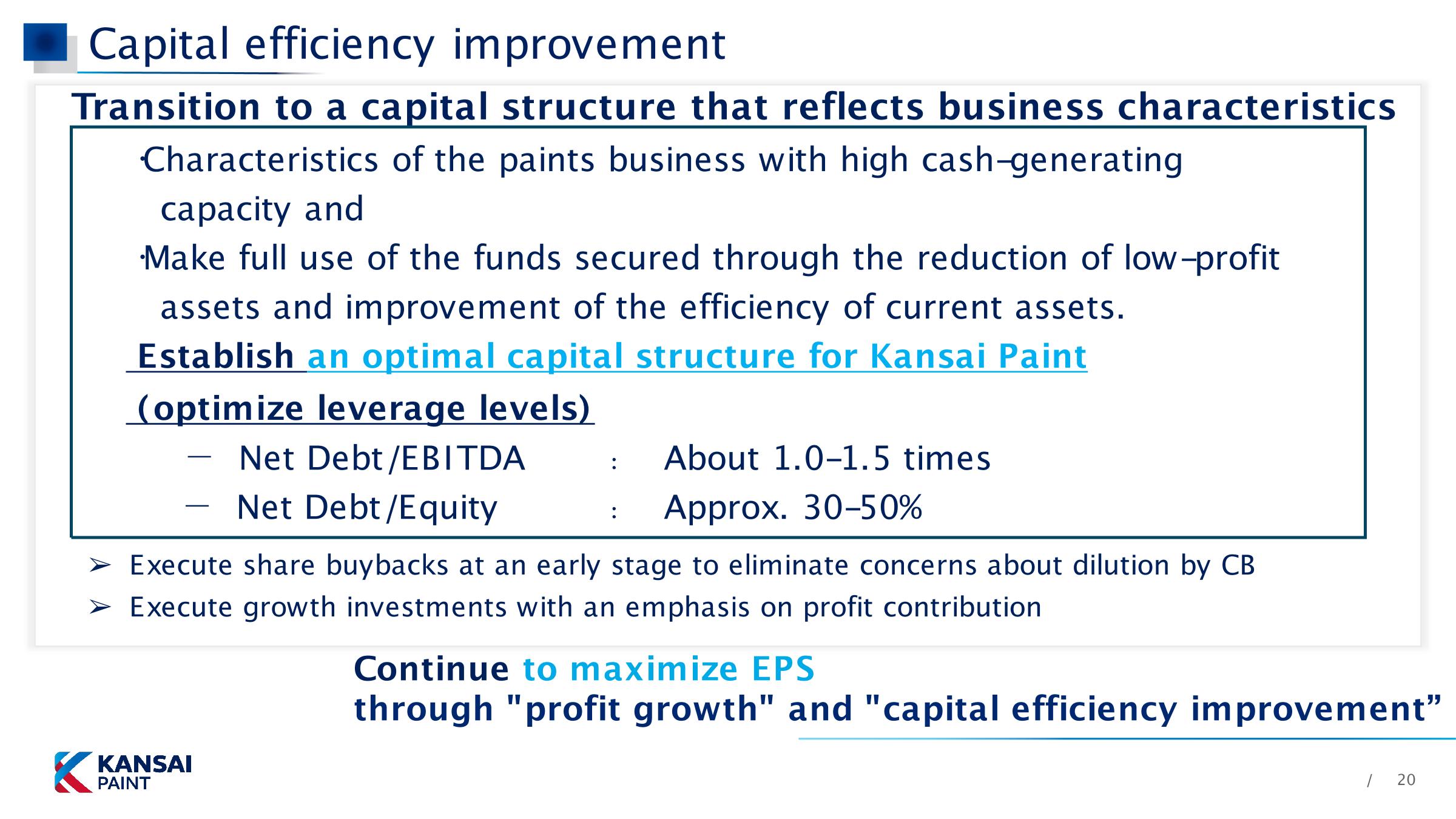

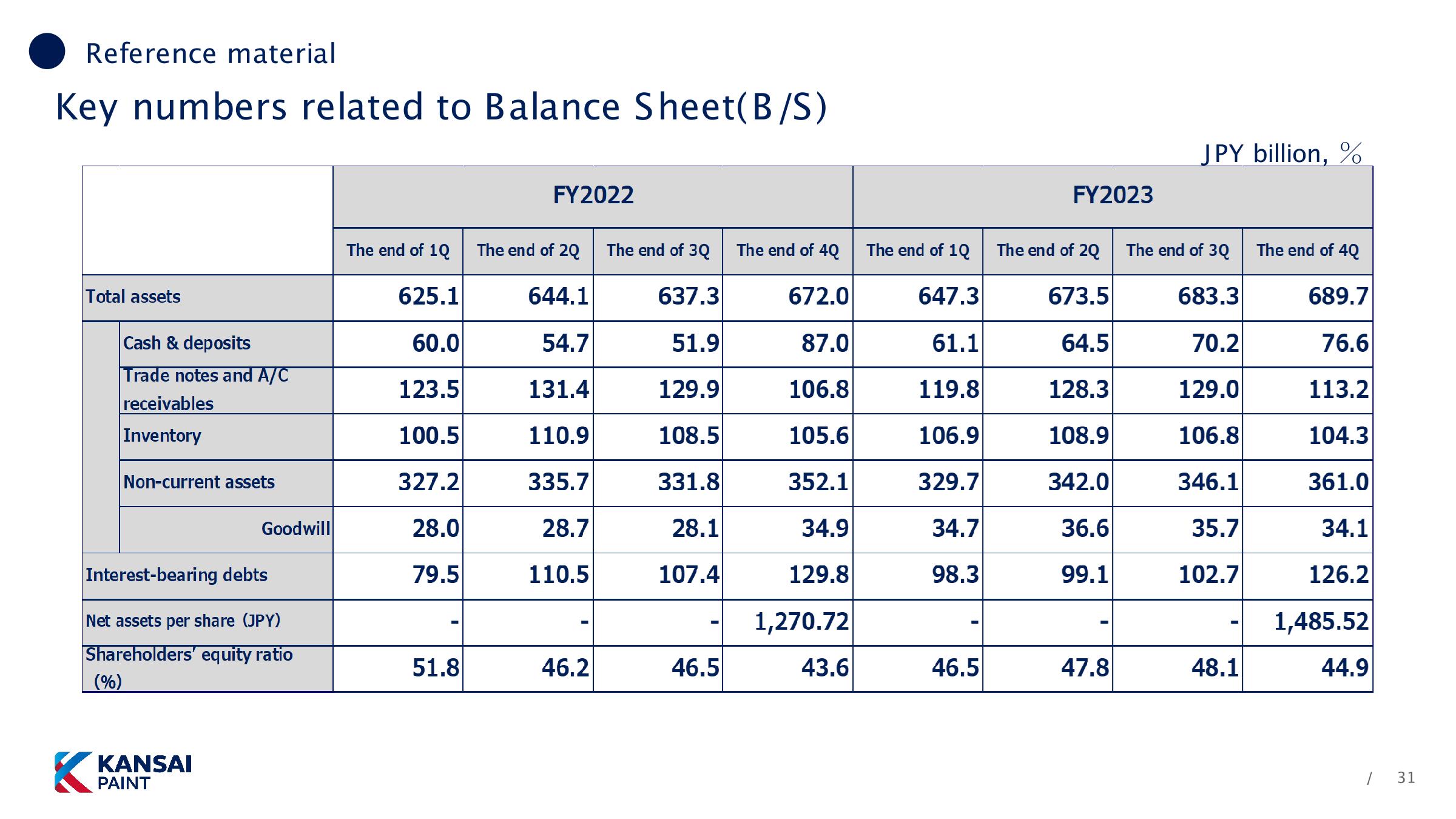

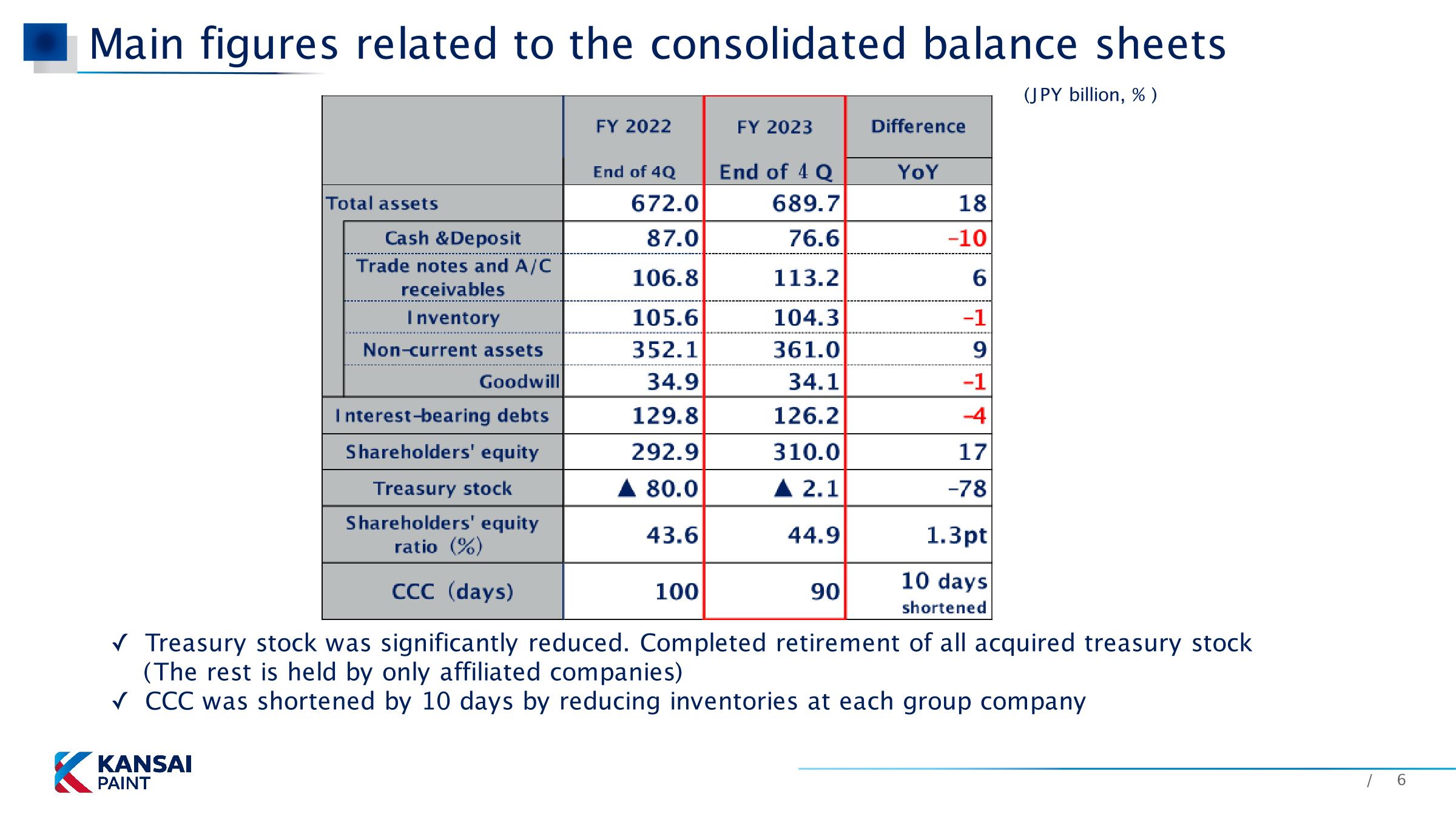

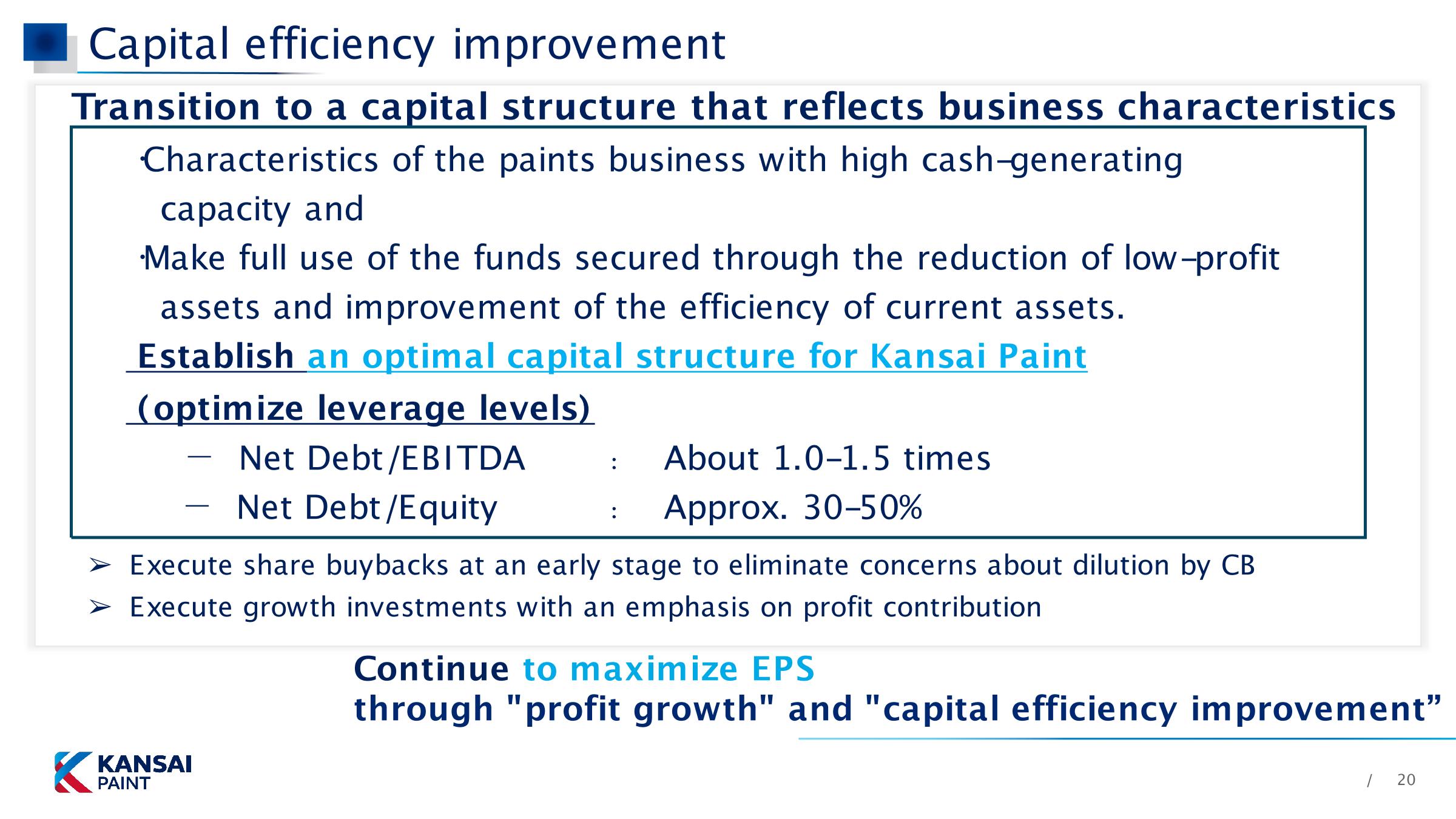

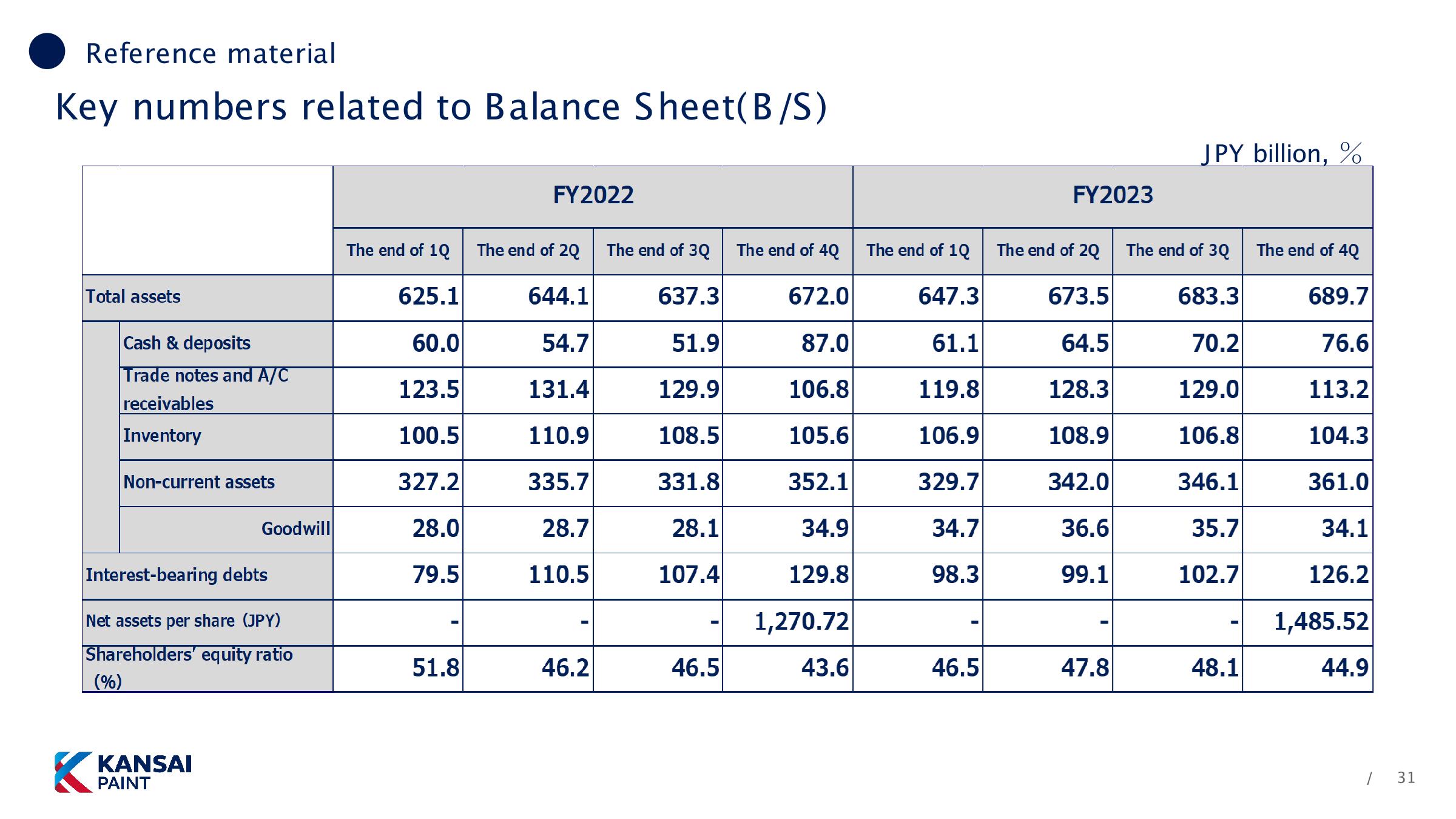

Improved capital efficiency through continuous improvement of capital efficiency (sale of

low-profit assets, significant improvement in CCC) and share buybacks.

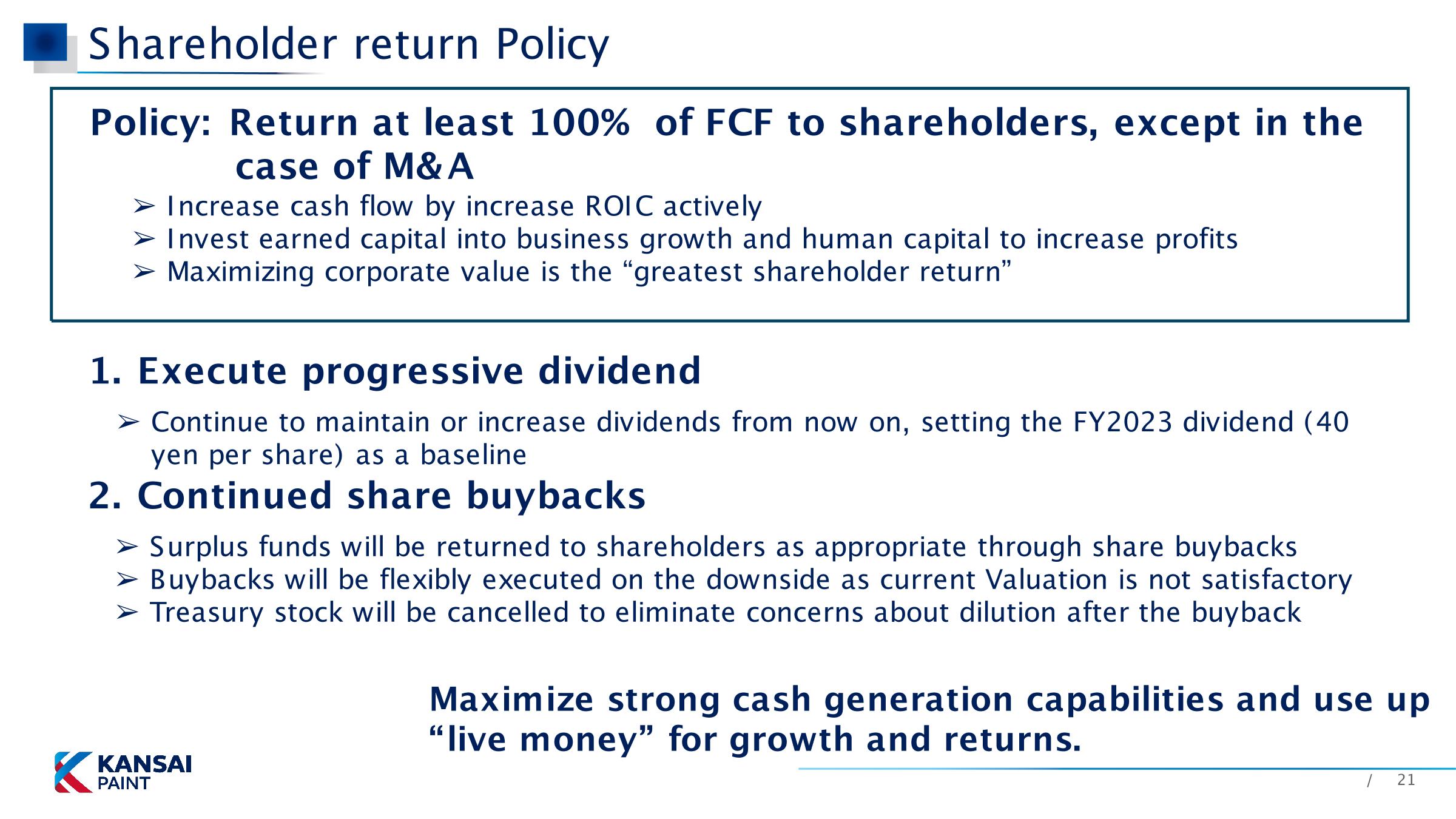

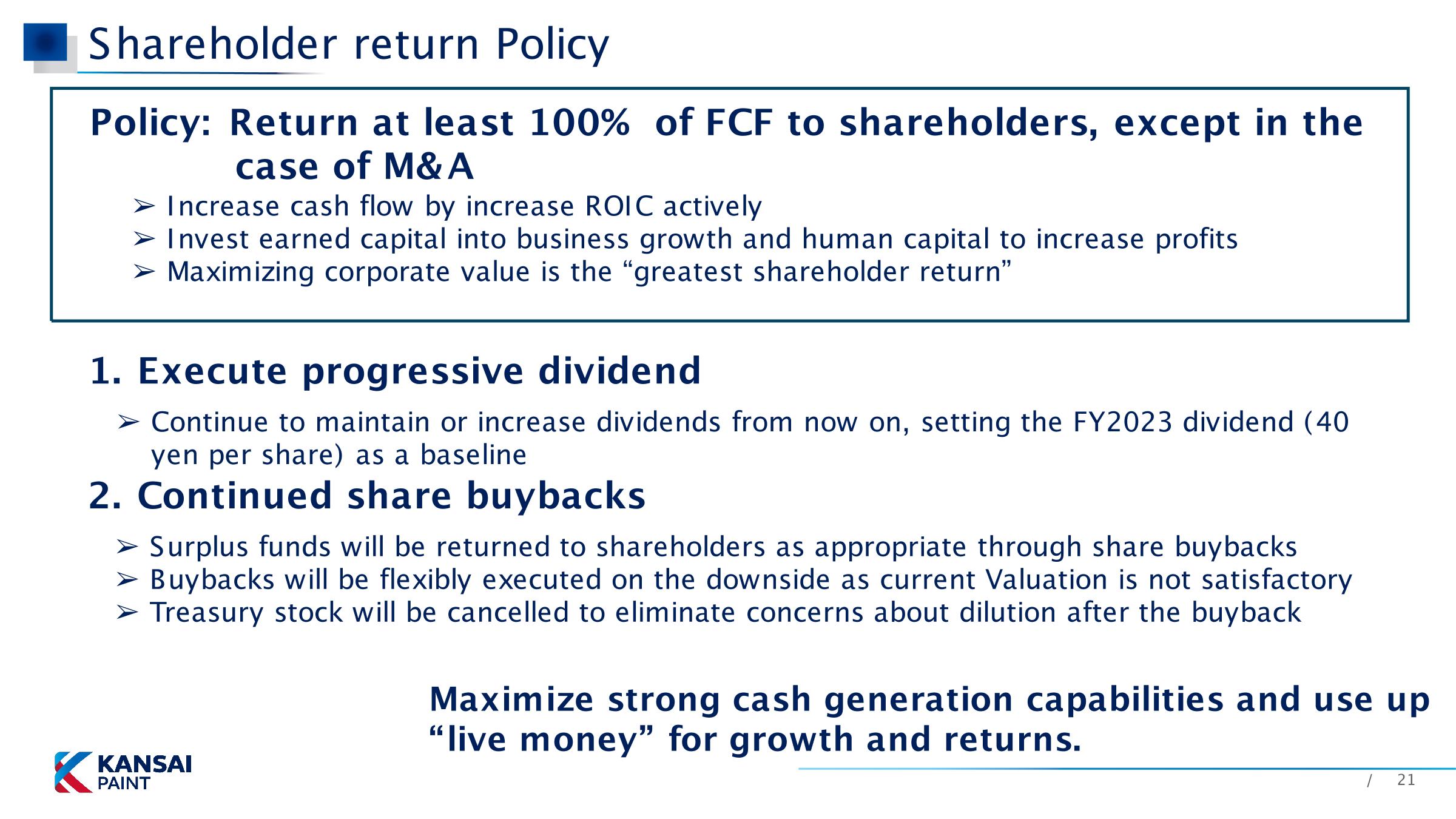

The dividend payout ratio, excluding one-time gains, will be maintained at 30%, and the annual dividend will be increased by 2 yen (from 38 yen to 40 yen) based on further growth in earnings.